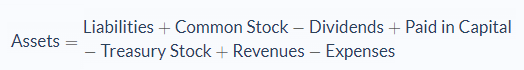

The expanded accounting equation has the same formula as the basic accounting equation—but categorizes the owner’s equity into four main aspects for a better understanding of the term.

The four elements inserted into the owner’s equity are the revenues, expenses, owner’s withdrawals, and owner’s capital.

The expanded accounting equation shows the relationship between the income statement and the statement of financial position by illustrating how the revenues and expenses of a company drift into the equity of a company’s accounting statements.

Revenue is the total amount of income earned through the sale of specific goods and services, while expenses are the money that is used on spending, to induce revenues. This section of the owner’s equity associates itself with the income statement, where the sales and the expenses are recorded to determine the net profit or net loss of a company, which then is added to the capital of the business.

The owner’s withdrawals are the drawings of the company, which are ejected out of the business by the proprietor for personal use. This factor reduces the equity of the owner of the corporation.

Owner’s capital can be characterized through the initial investment of the owner, partners and shareholders who are directly involved in the interest of the organization. The higher the investment, the higher the equity. The equity will decrease in the event of shareholders or partners leaving the company.

Components of The Accounting Equation

The accounting equation is used in the double-entry system. This equation determines the relationship between the assets, liabilities, and equity. The accounting equation is also known as the statement of financial position equation, as it shows the total number of assets, liabilities, and capital of a business, for a specific period.

The accounting equation is calculated as follows:

In accounting, assets are the economic resources owned by a business, which are expected to give future benefits in terms of value. Assets may have physical characteristics such as cash in hand, vehicles, machinery, inventories, and buildings. Assets can also exist in an intangible form as accounts receivable, the money owed by a company’s debtors, investments, and patents issued by an organization.

A liability is considered a financial debt. They are the value owed by a business to another firm. The person to whom the debt is owed is known as a creditor. Examples of liabilities in an organization are loans, goods or services purchased by a consumer on credit terms and unpaid salaries to employees etc.

Owner’s equity, also known as the capital of a business, comprises of the investment of the owner into the business, and the net profit of the year for a business deducted by the drawings made by the proprietor (the money withdrawn from the business for personal use).

Accounting Equation and The Balance Sheet

The balance sheet shows a company’s financial position at the end of a specific period. It is simply a detailed statement of the accounting equation. The balance of the owner’s equity and liabilities with the assets which shows the two views of the same business.

The balance sheet is a formal view of the accounting equation which is made by companies to monitor their progress. The statement of financial position is also monitored by shareholders to see the profitability of the organization. Moreover, the balance sheet is used to check the liquidity position of the company, by banks and sellers to see if the firm will be able to pay back the loans and the goods or services purchased on credit.

Expanded Accounting Equation for Different Business Structures

The expanded accounting equation differs from company to company based on the size and the economic structure of the business. The accounting equation is formalized in different methods for different setups.

Sole Proprietorship

Partnership

Corporation

It is imperative to note that in all business aspects, only the components of owner’s equity are changing, while there is no change in the assets and liabilities of any business framework.

Example of the Expanded Accounting Equation

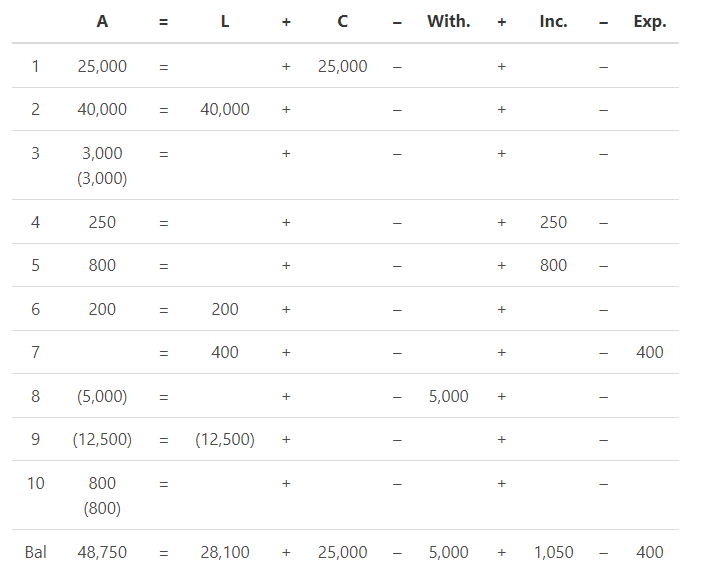

Assume the following transactions:

- Billy’s Corporation invested $25,000 to start their business

- The corporation loan $40,000 from their local bank.

- The purchase of new machinery costs $3,000.

- Rendered services and received cash, $250

- Rendered services on account, $800

- Paid their monthly electricity bill on account, $200

- Billy needs to repair its equipment for the cost of $400, which will be paid in 15 days.

- Billy draws $5000 from the business for personal use.

- Billy paid back a third of the loan obtained from the bank.

- The customer is #5 makes a payment for the services rendered.

The below calculation depicts the expanded accounting equation:

Notice that the equation stays in balance.

Importance of The Accounting Equation

The accounting equation is a major part of accounting as it helps businesses in calculating the assets, liabilities and owner’s equity for a particular time period. The accounting equation also helps investors monitor the profitability and financial position of a business.

The expanded accounting equation allows us to identify the impact on the owner’s equity in detail. For instance, such as equity increases due to revenues and expenses causing a reduction. The equation is also important as it helps accountants accurately determine the effect of a specific transaction with owners. This method also saves time and amendments can be made with ease.

FAQs

1. What is the expanded accounting equation?

The expanded accounting equation is the formula used to calculate the assets, liabilities and owner’s equity for a particular time period. The equation is also used to identify the impact on the owner’s equity in detail.

2. How is the expanded accounting equation written?

The expanded accounting equation is written as:

Assets = Liabilities + Owner’s Equity

3. What are the advantages of the expanded accounting equation?

The advantages of the expanded accounting equation include:

- Allows businesses to calculate the assets, liabilities and owner’s equity for a particular time period

- Helps investors monitor the profitability and financial position of a business

- Allows accountants accurately determine the effect of a specific transaction with owners

4. When should I use the expanded accounting equation?

The expanded accounting equation should be used when comparing the company's assets with greater clarity and understanding. The equation can be helpful in a number of different areas, such as when calculating the amount of cash available to a company or when trying to ascertain the total liabilities on the balance sheet.

5. What is the difference between the expanded accounting equation and the basic accounting equation?

The expanded accounting equation allows accountants to identify the impact on the owner’s equity in detail. The basic accounting equation does not provide this level of detail.

In addition, the expanded accounting equation helps accountants accurately determine the effect of a specific transaction with owners. The basic accounting equation does not have this capability.