Expense accounts are categories in a company’s books that show what day-to-day running costs the business had during a specific time period.

Expenses are simply costs that a company incurs in order to generate revenues. So if a company purchased a machine to produce goods, this is an expense that is being used to produce a product to sell, which can be sold to generate revenue.

Expense accounts are equity accounts that have debit balances. This means that an entry on the debit side (left side of the T-account) of the expense account means an increase in that account balance while an entry on the credit side means a decrease in the balance.

Expense accounts are contra equity accounts because their balance is linked to the overall equity balance. Put simply, as the expense account increases, the equity balance decreases.

To calculate the overall equity of the company, expenses are subtracted from revenue to calculate the net income which is shown on the income statement.

Example Types of Expense Accounts

Before viewing the different types of expense accounts, it is important to understand the two different types of costs or expenses that a business incurs.

Certain costs are fixed in nature. These are also known as indirect costs. They are termed as fixed as they remain constant throughout and have to be paid regardless of any business activity. If a building is operated on rent, the rent will be considered a fixed cost. It will have to be borne by the operator regardless of activity is taking place or not. Similarly, salary is another example of a fixed cost.

After direct cost, we have variable or indirect costs. Unlike fixed costs, they do not remain constant and vary with business activity. Meaning, the more a business produces the more variable costs it incurs. Examples of variable costs can be raw materials & electricity.

Now we look at the different types of expense accounts.

Cost of Goods Sold

For a manufacturing firm, the cost of goods sold is the cost of procuring raw materials and converting them into finished goods. Labor, manufacturing overheads and direct materials may also be included in this cost, as well as the cost of transporting raw materials and finished goods.

The cost of goods sold is generally recorded in the upper portion of the income and expenditure account. The amount is subtracted from revenues to arrive at the gross profit.

Operating Expenses

Operating expenses are the expenses that a company incurs in generating operating revenue. It could also be explained as the expenses incurred to run the core operations of an organization. Some examples of operating expenses include.

- Advertising expenses. Marketing is important to create and spread awareness of business & its product line. Companies such as Coca-Cola, Colgate, Unilever, etc., spend huge sums on advertising.

- Salaries. Salaries have to be paid and are normally fixed costs.

- Rent. Not all companies are unable to buy their property to operate businesses. Hence, such companies operate on rent. As mentioned above, rent is also an example of a fixed cost.

- Utilities. Companies also need utilities to operate. Some common examples of utilities can be electricity, gas, water, etc. These utilities can either be fixed or variable. Some are also semi-fixed. For example, a telephone company might charge a fixed rate for a certain number of calls. When that limit is reached, the rate may change from fixed to variable.

- Other expenses. A company might also occur some other expenses. Often extraordinary expenses are incurred due to one-off events. A recent example could be the expenses incurred due to the coronavirus pandemic. Also, companies might incur interest expense for borrowing money from banks or the issuance of bonds. Lastly, companies might also incur non-cash expenses in the form of depreciation & amortization.

All of the operating & other expenses are reported in the lower part of the income statement. These expenses are subtracted from gross profit to arrive at the net profit.

Nature of Expenses

In accounting terminology, account classes either have a debit or a credit nature. This is necessary as it helps equate the accounting equation and sets the foundation of the double accounting entry system. Expenses have a debit nature. This means that when expenses increase, the entry for expenses is debited and vice versa when they decline. An example can better be used to explain this.

Example

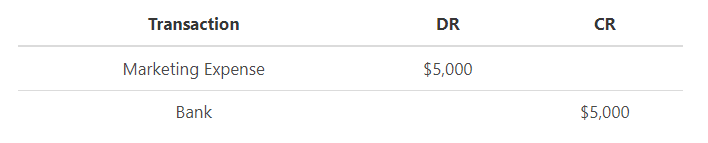

Company A incurs a marketing expense of $5,000. The amount is paid through cheque.

Marketing $5,000

Bank $5,000

As shown in the tables above, when the company incurs a marketing expense, the expense is increasing. Hence the T account of marketing expense is debited with $5,000. Similarly, the opposing entry of Bank which is an asset is credited with $5,000.

Cash or Accrual Basis

Expenses can either be recorded using cash or accrual basis of accounting. There is often a debate as to which method should be used to record expenses. While the cash basis of accounting may be simpler, the accrual basis is considered to be more accurate.

In the cash basis of accounting of expenses, the transaction is recorded as soon as cash is paid off. On an accrual basis, the transaction is recorded when the expense is incurred irrespective of the cash payout date.

Example

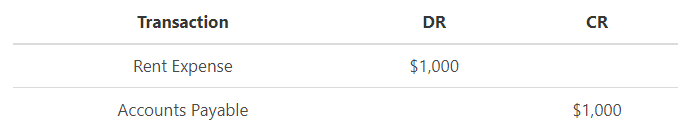

The company incurs Rent Expense of $1,000. The company pays the bill in the following month.

As per the accrual basis of accounting, the transaction will be recorded in the current month. The entry would be as follows.

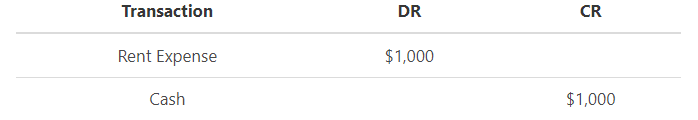

On the contrary, when recording using cash basis, the transaction will only be recorded when the cash is paid (In this case, in the following month). The double entry would be as follows.

Conclusion

Controlling expenses is an extremely important task for financial managers today. Optimization of expenses can help companies outperform the industry. However, this should also be done in a way where quality is not compromised. Quality is of extreme importance in industries such as airlines. Lowering costs by reducing quality can come to haunt a company in the form of severe penalties or ultimately closure of operations.

FAQs

1. What are expense accounts?

Expense accounts are a part of accounting where expenses incurred by a company are recorded. This might include electricity, water, gas, marketing, etc.

2. What are the types of expense accounts?

There are a variety of expense accounts that might be incurred by a company. This includes rent, salaries, interest, taxes, etc.

3. When should a business use an expense account?

A business should use an expense account when it incurs an expense. This might include monthly rent, the purchase of office supplies, or the payment of employee salaries.

4. What are examples of expense accounts?

Some common expense accounts include rent, salaries, marketing, and utilities.

5. Where are expense accounts listed?

Expense accounts are usually listed on the lower half of an income statement. This is where the company's operating and other expenses are recorded. These expenses are subtracted from gross profit to arrive at the net profit.