The future value of a growing annuity is the total value of a series of payments that are growing (or declining) at a constant rate during a certain time period.

To better understand this terminology, it is helpful to first understand the definition of an annuity and its types. An annuity is simply a series of cash instalments that are paid over a certain period of time, accompanied by an interest rate. A growing annuity is a series of equal payments over time that grow at a constant rate. It is sometimes referred to as a graduated annuity or an increasing annuity.

We are looking at the future value of these growing payments. The word “value” here means the financial limit that a series of payments can reach. The cash payments will grow at a constant rate that will be separate from the interest rate of the investment. The increased cash payments will then grow again within the investment because of the investment’s rate of increase.

Imagine if someone invests $1000 for payment 1, but then decides they can pay more than that every other time. We want to calculate how that would make a difference to the ending value of the investment.

However, the cash flow must be increasing at a constant rate. Meanwhile, the interest rate should remain the same. If we know these rates, we can plug it easily into the formula.

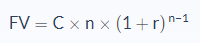

Future Value of a Growing Annuity Formula

.png?width=242&name=Screenshot%20(64).png)

- C = cash value of the first payment

- r = interest rate

- g = growth rate

- n = number of periods

Also, the frequency of the interest rate should match the frequency of the payments. If you are talking about monthly payments, then the interest rate should be monthly. The interest rate is often referred to here as the discount rate, or rate of return.

FV of Growing Annuity if r = g

You might come across a situation where the interest rate (r) and the growth rate (g) are the same. In this case the above formula would not work any you’d get an error.

The solution is to calculate the future value of the annuity without the growth rate using the below formula:

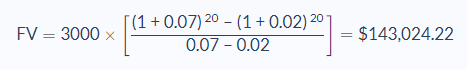

Future Value of a Growing Annuity Example

Greg is considering opening an investment account. It has an annual interest rate of 7%. This year at work he received a $3000 bonus, and he’s trying to decide if he should put it towards the account in its first year. His company has committed to increasing his bonus by 2% each year until he retires. He plans to put that money into the retirement account every year. If he works for 20 additional years before he retires, what would be the future value of this growing annuity?

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Cash value of the payment made in the first period (C): 3000

- Interest rate (r): 7% or 0.07

- Number of Payments (n): 20

- The growth rate of the payments (g): 2% or 0.02

- Future Value of a Growing Annuity (FV): Unknown

In this case, the future value of his investment account with steadily increasing payments would be $143,024.22

Working through this possibility helps to explain how the value of money can change over time. As Greg is making this decision, he could compare this end result to other types of accounts with different interest rates. He can also now consider the purchasing power of his invested money, versus its purchasing power now or in small increments. He can more accurately evaluate whether he would prefer cash in hand now or the sum of the money’s future value.

Future Value of a Growing Annuity Analysis

The most popular reason for calculating the future value of a growing annuity is retirement planning. This is useful because it makes sense for the payments you make towards something to increase. The cost of living increases annually and many employers account for that, which can be an important factor in the growth rate changing. Also, many individuals grow in their careers over time, resulting in increased compensation. As compensation increases, people want to contribute more to their investment accounts to build wealth towards their retirement.

Additionally, you can use this formula to calculate other set payments with growing or changing payment amounts. In an effort to retain renters, some rental properties have it written into their leases that there will be an annual decrease for the rent at a constant rate.

You could also use the formula when setting up a college fund for a child. Most universities increase their tuition rate over time. This would mean that your payments into the fund would need to increase at that same rate. So, understanding the future value of that growing account would be very helpful in planning for college payments.

Future Value of a Growing Annuity Conclusion

- Future value of a growing annuity is an analytical tool used to find the final sum of a series of investments.

- Future value of a growing annuity formula is primarily used to factor in the growth rate of periodic payments made over time.

- The calculation for the future value of a growing annuity uses 4 variables: cash value of the first payment, interest rate, growth rate of the payments over time, and the number of payments.

- In a growing annuity, the payments would be made at the end of the pay period.

Future Value of a Growing Annuity Calculator

You can use the future value of a growing annuity calculator below to quickly discover the cash value of your future, growing payments by entering the required numbers.

FAQs

1. What is the future value of a growing annuity?

The future value of a growing annuity is the total value of an investment account at a certain time in the future. This is used for planning retirement and other large expenses that would require regular investments over time.

2. How do you calculate the future value of a growing annuity?

The future value of a growing annuity is calculated by multiplying the starting value of an investment account times the interest rate minus the growth rate. Then, you must divide that result times the interest rate plus the growth rate. Take that answer and subtract it from your initial amount to get the final number.

3. How do you calculate the future value of a growing annuity in Excel?

The future value of a growing annuity can be calculated in Excel by inputting all four variables into the formula "=(1+$D2)^(12*($C2-$G2))/(1+$B2)." This is what pulls the future value calculation.

4. What is a growing annuity?

A growing annuity is a periodic payment made over time that changes in value due to the changing interest rate. In a growing annuity, you can choose to have larger payments at the end of each pay period or make smaller payments throughout each pay period and receive more money overall.

5. What is an example of a growing annuity?

An example of a growing annuity is purchasing an item on credit with an initial payment followed by regular installments. This type of purchase would have the initial payment plus the growth rate in the formula.