Leverage is an investment strategy that used debt (borrowed capital) to fund an investment or to expand an asset base for a company. Put simply, leverage is the use of debt by a company in order to multiple the potential returns.

Operating Leverage

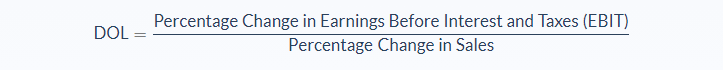

Operating leverage results from the presence of fixed operating costs in a firm’s income stream. The extent of the presence of fixed operating costs in a firm’s income stream is measured by the degree of operating leverage (DOL).

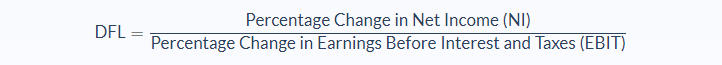

Financial leverage results from the presence of fixed financial costs in a firm’s income stream. The extent of the presence of fixed financial costs in a firm’s income stream is measured by the degree of financial leverage (DFL).

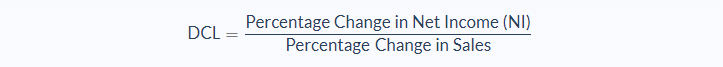

Firms often have both operating and financial leverage. This total or combined leverage results from the presence of both fixed operating and financial costs in a firm’s income stream. Combined leverage is measured by the degree of combined leverage (DCL).

Firms often have both operating and financial leverage. This total or combined leverage results from the presence of both fixed operating and financial costs in a firm’s income stream. Combined leverage is measured by the degree of combined leverage (DCL).

Notice that DCL = DFL × DOL.

Notice that DCL = DFL × DOL.

Degree of Leverage

Firms that have greater degrees of leverage have greater levels of fixed costs. And as such, they tend to have greater break-even points than do firms that do not have leverage. The advantage of having greater degrees of leverage is that as a firm’s sales volume increases beyond the break-even point, its margins improve. The disadvantage of having greater degrees of leverage is that the break-even point is higher, which means that the firm is required to achieve a higher sales volume to reach the break-even point. In good times when sales are high, a higher degree of leverage allows a firm to maximize profits. In bad times when sales are not as good, the firm can minimize its losses by having a lower degree of leverage.

Example:

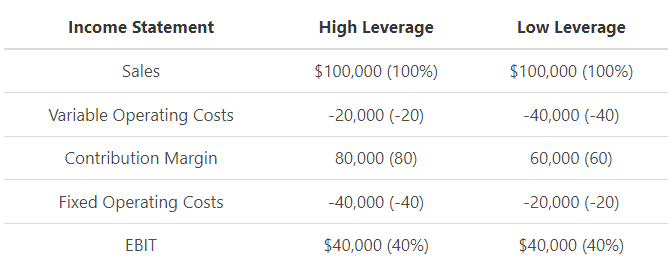

In the example below, a firm’s projected EBIT under two very different cost structures.

Notice the firm experiences the same level of sales, while it has very different cost structures.

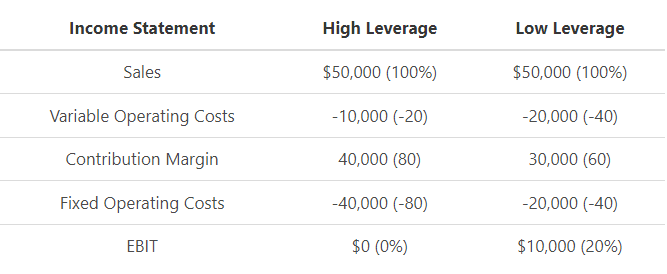

Now notice what happens to the firm under each option when their sales decrease to $50,000.

When the sales drop to $50,000, the high leverage option declines to its break-even point while the low leverage option minimizes the loss. Now notice what happens to the firm’s sales increase to $150,000.

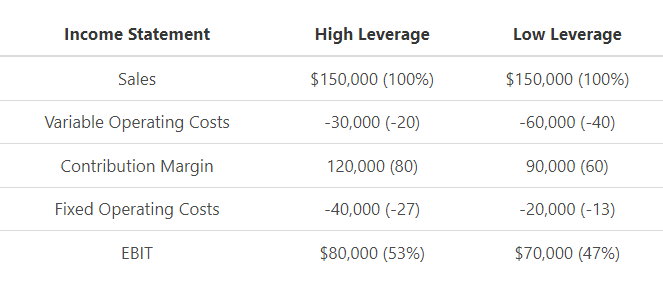

When a firm’s sales increase, the cost structure option with a higher degree of leverage can maximize the firm’s profits.

This overview was developed by Eric Maneval.

No adaptation of its content is permitted without permission.

FAQs

1. What do you mean by leverage?

Leverage is the use of borrowed money to increase the potential return on investment. When a company has more debt than equity, it is considered highly leveraged. This means that the company is using its debt to finance its operations. A high degree of leverage can lead to greater profits in good times but can also lead to greater.

2. How do you calculate operating leverage?

Operating leverage is calculated by dividing the firm's fixed operating costs by its contribution margin. Fixed operating costs are those costs that do not change with sales volumes, such as rent and utilities. The contribution margin is the difference between a company's sales and its variable costs.

3. Is high operating leverage good?

High operating leverage is not good or bad in and of itself. It can be seen as a positive or negative depending on the company's circumstances. A high degree of operating leverage can lead to greater profits in good times but can also lead to greater losses in bad times.

4. What is considered low operating leverage?

Low operating leverage is when a company's fixed operating costs are a high percentage of its contribution margin. This means that the company is not using much debt to finance its operations and is mostly reliant on its own profits. A low degree of operating leverage can lead to smaller profits in good times, but also smaller losses in bad times.

5. Why is operating leverage important?

Operating leverage is important because it measures a company's risk. A high degree of operating leverage means that a company is riskier, as it is more reliant on its debt to finance its operations. A low degree of operating leverage means that a company is less risky, as it is not using much debt to finance its operations.