The LIFO method is an acronym used in accounting and many computational concepts for Last-In, First-Out. In accounting, this is used to compute the number of goods sold over a duration of time when taking inventory. This method makes use of the first in, last out technique generally used in stacking things. This means that items that are bought last are calculated as sold first. The cost of freshly manufactured or acquired products is assigned first and the earlier prices are assigned to ending inventory count. This method is the cousin to the FIFO method.

Imagine you have ten pairs of china plates that you are stacking inside a box while packing. Put the china plates on top of each other in a box. When you are putting it in, you will have to put the first one in first, the second one on top of that, and so on and so forth. If you open the box, the first plate that you will take out will be the last one that you put in while you were packing.

Example of LIFO

Let’s say you are the owner of a clothing store and you ordered ten shirts at $10 each. Three days later, you made another order of 20 shirts at $15 each. After a week, your inventory showed that 15 shirts have been sold. You now want to record the inventory cost. If you are to make use of the LIFO method, how much can you put down as the cost of sold goods?

Now we are assuming that all the shirts are sold at the same price of $50 per shirt. However, the price at which you bought them varies. When calculating the cost of the shirts, you would calculate it at $15 dollars per shirt since this is the last known price of your inventory purchase. This will mean that cost of the shirts will be recorded as $225 dollars. At $50 sales price, the income will be recorded as (50 x 15) – 225. The profit made on those 15 shirts will be $525 dollars. This means that even though you bought the first 10 shirts at $20 dollars, the first shirts to be calculated will be the last ones that were bought.

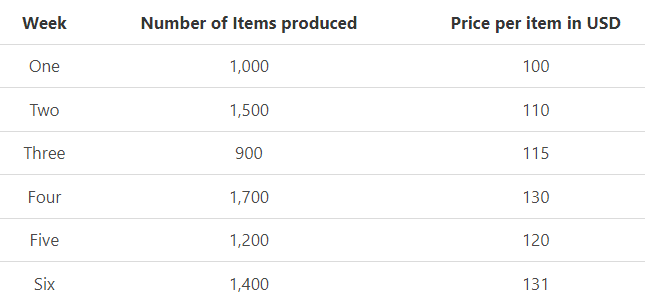

Let us take a look at a more comprehensive example of the calculation COGS (Cost of goods sold) using the LIFO method. Tommy owns a face cream production company and below is the account of his face cream production cost in the last six weeks.

Over the course of these six business weeks, he has packed and sold five thousand face creams at the price of 200 USD per cup. Now he wants to calculate the cost of goods sold while taking the inventory using the LIFO method.

Solution

The total amount of products sold is 5,000 but because we are using LIFO, we will start from week six and move backward.

Week six

1400 x 131 = 183,400

Week five

1200 x 120 = 144,000

Week four

1700 x 130 = 221,000

Week three

700 x 115 = 80,500

Total costs of goods sold = 628,900.

If you look at the calculations above, you will notice that instead of going from calculating the cost from week one, we instead started with the most recent week and worked backward. This means that the latest products get priority over the old ones. If you pay close attention, you also will notice that when we get to week three, we only sold 700 from the 900 produced that week. If he sold another 2,000 cups, we would start calculating costs from week three, except now it will be 200 cups produced in week three.

When and Why Companies Use LIFO

At a glance, taking inventory of the latest purchase and leaving the old ones do seem like a crazy idea. After all, first come first serve seems like a more fair deal, doesn’t it? However, if you take into account the fact that the price of most things depreciates over time, it makes sense to use the latest price. Imagine you bought 10 products for $5 and another 10 for $6 and decided to take the inventory at the first price, only to realize it’s actually $10. That would mean that your calculated profit will be higher than it actually is.

If the production price of products keeps rising over time, using the LIFO method to take inventory will mean that the price of recently acquired items will be recorded and it will always be higher than the cost of previously bought items. This makes the ending inventory balance reflect earlier costs and the costs of goods sold to reflect the current cost of goods. This increases the recorded cost of goods, reduces the recorded profit, and therefore lowers income taxes as well.

In a stable economy, LIFO and FIFO have the same effects on the recorded inventory and yield the same amount of recorded income. If the production price of items keeps increasing that LIFO has a positive impact on companies. LIFO favors companies in an inflating society and disfavors them in a deflating society.

Conclusion

The LIFO method is a technique that is used to find the cost of inventory, similar to FIFO but very different. In LIFO, the cost of the recently produced or purchased goods is reported first and the previous product acquired is recorded last.

In an inflating economy, LIFO decreases the amount of taxable income by creating a higher cost of production or purchase and reduces the amount of recorded income. In a deflating economy, the complete opposite is true. It reports the cost of production or purchase to appear lower than it is and increases the taxable income.

More often than not, the LIFO method is used theoretically because, in the long run, its inventory may become very inaccurate and outdated. Most companies use this method but not completely to calculate its inventory evaluation.

FAQs

1. What does LIFO mean?

LIFO stands for last in, first out. It is a method of accounting where a company calculates its ending inventory by using the most recent purchases and products rather than the beginning purchases and products.

2. What is the LIFO rule?

The LIFO rule is a method of accounting for inventory levels that have been created or sold during different years.

3. Why is LIFO banned under IFRS?

LIFO is banned under IFRS because it distorts the inventory values and may affect a company's financial performance, as well as its management decisions.

4. Is LIFO acceptable under GAAP?

It is acceptable if it is used for both International Financial Reporting Standards and the financial reporting standards of the individual country.

5. Why would a company use FIFO instead of LIFO?

A company may use FIFO instead of LIFO if it wants to show a more accurate inventory amount. If a company uses FIFO, they will be able to find the correct amount of its cost of production or acquisition and accurately record that number as the cost of goods sold.