LIFO reserve is a bookkeeping technique that tracks the difference between the LIFO and FIFO cost of inventory. It takes the result of the cost of inventory found using the LIFO method and subtracts it from the value of the cost of inventory recorded using the FIFO method. This data is stored in an accounting inventory ledger called the LIFO reserve.

LIFO vs. FIFO

The FIFO is the first in-first out method used in accounting. The issue with taking inventory with this method is that if there is a gradual increase in the cost of goods, then more profit than it is being made is recorded.

The LIFO method, on the other hand, is the Last in Last Out technique used to take inventory. This method records a high cost of goods and a low amount of profit made, thus reducing the amount of taxable income. Most companies tend to lean towards using LIFO because it uses their latest inventory to calculate the cost of sold goods. In an inflating economy, this makes the cost of goods sold appear higher than it is. Making the cost of goods sold high reduces the recorded amount of profit along with taxable income.

The problem with LIFO is that it only works in an economy where the cost of things is constantly rising. Most countries have prohibited the use of this accounting technique except under very special circumstances.

There is, however, a compromise. The LIFO reserve is used by a company when it calculates its inventory and cost of goods using the First in First Out method but records it under The Last in Last Out method when doing the inventory report. This means that the gap between LIFO and FIFO is bridged and met halfway.

An instance of this is when a company uses the LIFO reserve to submit earnings to tax services when the cost of production is constantly rising but uses LIFO internally to calculate budgets and higher margins.

LIFO Reserve, LIFO, and FIFO calculations

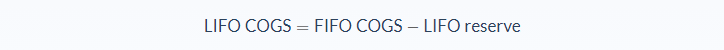

From the definition above, acquiring the LIFO reserve seems very straightforward. It is gotten by subtracting LIFO from FIFO or vice versa.

FIFO is subtracted from LIFO because, in a rising economy, we assume that LIFO is always higher than FIFO. It goes vice versa as well, which means you can subtract LIFO from FIFO. This is also used to track the difference between the company using the LIFO method and those using the FIFO method.

FIFO is subtracted from LIFO because, in a rising economy, we assume that LIFO is always higher than FIFO. It goes vice versa as well, which means you can subtract LIFO from FIFO. This is also used to track the difference between the company using the LIFO method and those using the FIFO method.

When looking for the LIFO reserve, timing is of great value. The time that LIFO starts and the time that FIFO starts is of great significance if you want the result of your LIFO reserve to be accurate. If you want precision, you may take the LIFO reserve as far back as one year, along with a representation of how that year’s economy was.

In accounting, a contra accountant is a ledger account that takes two different methods of taking the same inventory and saves the difference between these two methods. LIFO Reserve is a contra account because it takes two accounting techniques, LIFO and FIFO, and records the difference between the two methods.

LIFO Method of Inventory

In this method of inventory, the cost of goods sold is calculated by starting with the latest goods bought. For instance, if you bought 100 lipsticks in week one at $10 each, 90 lipsticks in week two at $15 each, and you bought 150 in week three at $20 each. By the end of the third week, you sold 250 lipsticks. Your inventory will assume that you started selling the lipsticks from week three first. When you ran through those at week three, you started selling those you bought in week two and so forth. Because the cost of lipstick keeps rising, your cost of goods sold will be high too.

FIFO Method of Inventory

In the First in First Out method, it is assumed that you sell the products you purchased earlier first before moving on to the next product. Looking at the same instance in the LIFO method, if you were to take the inventory using the FIFO method, you would have to assume that you sold the lipsticks in week one first, and when those finished you moved on to week two and then week three, and so forth. There is no difference between the LIFO and FIFO methods if the cost of goods remains constant. In the real market, that is nearly impossible.

Example of LIFO Reserve

If you have an inventory and want to take the LIFO reserve, you have to first find the FIFO and LIFO COGS (Cost of Goods Sold) for that inventory.

This means that you can find LIFO by

This means that you can find LIFO by

And

And

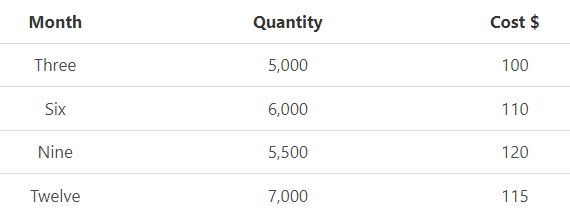

Let us assume that you want to find the LIFO reserve of inventory in a hair dye manufacturing company that you own using the data below. What will be the COGS using LIFO and FIFO is if the number of goods sold is 15,000 cartons of hair dye?

Let us assume that you want to find the LIFO reserve of inventory in a hair dye manufacturing company that you own using the data below. What will be the COGS using LIFO and FIFO is if the number of goods sold is 15,000 cartons of hair dye?

First we will calculate the COGS using the FIFO method. This will be (5000×100) + (6000×110) + (4000×120) = 1,640,000.

You will notice that in the ninth month, we only calculated 4000 cartons because not the whole 5,500 cartons made were sold.

First we will calculate the COGS using the LIFO method. This will be (7000×115) + (5500×120) + (2500×110) = 1,740,000.

In this case, the LIFO reserve will be the difference between the LIFO COGS and the FIFO COGS, which is 100,000.

Conclusion

The LIFO reserve is a ledger account that records the difference between the FIFO and LIFO methods of the inventory report. It helps in outlining the many differences between using the LIFO method and using the FIFO method. Looking at both the LIFO and FIFO methods, both have advantages and disadvantages and work better under certain conditions.

The FIFO method favors a stable or deflating Economy, and the LIFO method favors an inflating economy. The LIFO reserve, however, shows a complete and total picture of a company’s finances (profits, sales, costs, revenue, etc.) in all situations. When investors go through the LIFO reserve, they can both see how much money the company may lose on taxes, and how the actual cost of goods is affecting the inventory value and does a great job in catching an investor’s eye.

FAQs

1. What is a LIFO reserve?

The LIFO reserve is a ledger account that records the difference between the FIFO and LIFO methods of the inventory report.

2. What are the benefits of LIFO reserve?

The benefits of the LIFO reserve are that it records the difference between the FIFO and LIFO methods of inventory, shows a complete and total picture of a company’s finances, catches an investor’s eye, and helps investors see how much money the company may lose on taxes.

3. What does it mean if LIFO reserve increases?

It means that the company is using the LIFO method to value their inventory and as a result, their COGS (Cost of Goods Sold) will be higher.

4. What happens when the LIFO reserve is depleted?

If the LIFO reserve is depleted, it means that the company has used up all its LIFO reserves and will now have to use the FIFO method to value its inventory. This will result in a decrease in COGS (Cost of Goods Sold).

5. What is the purpose of a LIFO reserve?

The LIFO reserve is an account used to bridge the gap between the FIFO and LIFO methods of inventory valuation. The reserve helps to outline the many differences between the two methods and shows how each method would affect the company’s COGS (Cost of Goods Sold) in different situations.