Long term debt to equity ratio is a leverage ratio comparing the total amount of long-term debt against the shareholders’ equity of a company. The goal of this ratio is to determine how much leverage the company is taking. A higher ratio means the company is taking on more debt. This, in turn, often makes them more prone to financial risk.

Long term debt to equity is a variation of the debt to equity ratio. Debt to equity takes into account short-term debt, long-term debt, and other fixed payments. Meanwhile, long-term debt to equity only calculates long-term debt. Some analysts prefer the latter ratio since long-term debt tends to be more burdening and has more risk compared to other liabilities.

Additionally, apart from the current ratio, looking at one company’s past results is also a good idea. That way, we can observe whether the level of leverage is increasing or decreasing. Even if a company has a high long term debt to equity ratio, it would still have a better reputation if the ratio lowers year-over-year.

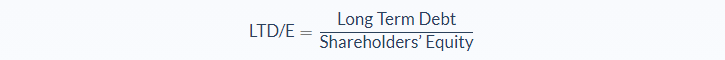

Long Term Debt to Equity Ratio Formula

To get the value of long-term debt, you should be able to find it listed in the liabilities section of the company’s balance sheet. Long-term debt consists of loans or other debt obligations that are due in more than 12 months. Any kind of debt needed to be paid off in less than one year, i.e. short term debt, is not included in the calculation.

To get the value of long-term debt, you should be able to find it listed in the liabilities section of the company’s balance sheet. Long-term debt consists of loans or other debt obligations that are due in more than 12 months. Any kind of debt needed to be paid off in less than one year, i.e. short term debt, is not included in the calculation.

Keep in mind that debt is different from liability. Liabilities encompass all types of debt, but not all liabilities are debts. Debts fund an entity—be it an individual or a corporation—borrowed that needs to be paid back before it’s due. Meanwhile, liabilities are something, e.g. money, goods, service, an entity owes to another party but not always in the form of debt. Some of the examples of non-debt liabilities are wages and deferred revenue (income received by a company for not yet delivered service to customers).

To calculate the formula above, you need to simply look at the long-term debt value under non-current or long-term liabilities. However, remember that we are not adding all of the long-term liabilities (as some of them might be non-debt liabilities) even if they are also obligations that mature in more than a year.

The second variable we need is shareholders’ equity. The value of shareholders’ equity can usually be found on the balance sheet as well. As a side note, shareholders’ equity is often called stockholders’ equity, owners’ equity, or simply equity. In terms of corporations, all of these terms refer to the same thing, which is total assets minus total liabilities. With that said, there may be very slight differences between shareholders’ equity and equity in some cases.

Long Term Debt to Equity Ratio Example

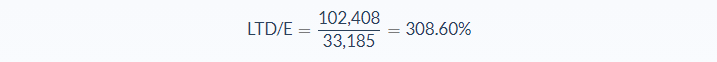

For this example, we will look into the balance sheet of the American automaker corporation, GoCar, in the fiscal year of 2019. From the balance sheet, we can see that the business has a long-term debt amount of $102,408 million. Meanwhile, the total shareholders’ equity ratio is $33,185 million. What is the long term debt to equity ratio of GoCar?

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Long term debt (in million) = 102,408

- Shareholders’ equity (in million) = 33,185

We can apply the values to the formula and calculate the long term debt to equity ratio:

In this case, the long term debt to equity ratio would be 3.0860 or 308.60%.

In this case, the long term debt to equity ratio would be 3.0860 or 308.60%.

From this result, we can see that the value of long-term debt for GoCar is about three times as big as its shareholders’ equity. This seems to be a very high number, considering that we don’t even take into account other kinds of liabilities. At first glance, the corporation may be taking too much risk. However, to get a more accurate outlook, you may wish to compare this result against the industry’s standard as well as the business’ past results.

Long Term Debt to Equity Ratio Analysis

Long term debt to equity ratio can be vital in determining how risky a business is. For investors and creditors, understanding the proportion of debt, especially long-term, can be a deciding factor in whether a business can be trusted to run a successful operation. Recall that some analysts may put more emphasis on long-term debt. This is because it’s often considered riskier than short-term debt or current liabilities as a whole.

Unfortunately, there’s no ideal number for this ratio. In order to get a solid grasp of how much leverage or risk a business takes, we need to compare the ratio of a particular company against its competitors within the same industry. This aspect is important since companies from different industries have varying standards in the way of managing their debt.

For instance, capital-intensive corporations (businesses that require large investments in the capital) will most likely have a higher debt ratio compared to companies that are not as assets dependent. On a side note, this doesn’t necessarily mean that capital-intensive companies have higher risk as the stability of the cash inflows need to be considered.

One last thing to note is that a low long term debt to equity isn’t always a good indicator. Companies that are reluctant to use debt usually have a tougher time growing their business. As a result, investors won’t get a satisfactory results in the future. In a different circumstance, low income companies would naturally have a lower proportion of debt as well to avoid bankruptcy. That’s why it’s important for lenders and investors alike to take advantage of other indicators to make a good judgment.

Long Term Debt to Equity Ratio Conclusion

- The long term debt to equity ratio is an indicator measuring the amount of long-term debt compared to stockholders’ equity.

- The formula for long term debt to equity ratio requires two variables: long term debt and shareholders’ equity.

- Not all long-term liabilities are long-term debt. Some of them may be non-debt liabilities that also need to be resolved in more than 12 months.

Long Term Debt to Equity Ratio Calculator

You can use the long term debt to equity ratio calculator below to quickly determine the amount of long-term debt compared to stockholders’ equity by entering the required numbers.

FAQs

1. What is a long-term debt to equity ratio?

The long-term debt to equity ratio is a comparison between a company’s long-term debts and shareholders’ equity. This ratio indicates how much the company owes and its proportion in comparison to shareholders’ equity.

2. Why is the long-term debt to equity ratio important?

The long-term debt to equity ratio helps you analyze the company’s financial situation. This information can be vital in determining whether an investment would bring about positive returns on your money. Also, this ratio shows what part of the business you own (or will own in the future).

3. What is the formula for the long-term debt to equity ratio?

The formula for the long-term debt to equity ratio is:

LTD/E = Shareholders’ Equity / Long Term Debt

4. Why do companies have long-term debt?

Long-term debt helps a company expand its operations by using it for capital-intensive plans. For example, you can build factories, purchase more inventories, and add equipment. These things require a lot of money, so you can use long-term debt to pay for them over time.

5. What is a good long-term debt to equity ratio?

There isn’t a universal "good" or average long-term debt to equity ratio, but it should be at least 3% of total assets for small businesses. Large companies should have more than 40% of long-term debt to equity.