Net debt is a liquidity metric that measures a company’s ability to settle all of its debts should they need to be paid immediately. Put simply, net debt indicates the amount of debt a company owes, as shown on its balance sheet, versus its liquid assets.

The value is equal to the amount of cash that would be left if the company were to pay off its debts. It reveals whether the business is liquid enough to meet its debt obligations.

While a company may experience financial difficulties if it is overburdened with debt, the debt’s maturity should also be monitored. If the company has mostly short-term debts, its obligations will be due within the next 12 months. That means it should be able to make adequate income along with available liquid assets to pay the debt maturities. Investors have to verify that the business will be able to pay their short-term debts in case the company’s sales dive.

In contrast, let’s say a business’ current revenue stream only covers short-term debt and not long-term debt. The company would be expected to encounter financial troubles and needing additional financing. Because different companies use debt in various ways, a company’s net debt must be compared to those in the same industry.

Debt management is vital for businesses, if only to make additional funding easily available if necessary. New debt is a critical part of creating a growth strategy. It helps businesses decide if revenue should be spent on expansion or repayment of debt.

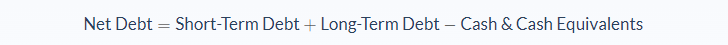

Net Debt Formula

This metric is partly calculated based on the company’s total debt, which includes long-term as well as short-term obligations. At the same time, it requires knowing the total cash owned by the business. As opposed to the debt value, total cash covers cash and highly liquid assets. Cash and cash equivalents include savings and checking account balances, stocks and certain marketable securities. However, a lot of businesses do not consider marketable securities as cash equivalents because it will depend on the specific investment vehicle and whether it can be converted to cash in 90 days or shorter.

Total debt is the sum of a company’s short-term (short-term bank loans, lease payments, accounts payable, etc.) and long-term (bonds, term loans, notes payable, etc.) debts. On the other hand, cash and cash equivalents refer to all cash and liquid instruments with a maximum maturity of 90 days. They must be able to quickly be converted to cash (treasury bills, commercial paper, certificates of deposit, etc.).

Although the net debt figure is a good place to begin, a wise investor should scrutinize the details of the company’s debt level as well. The actual short-term and long-term debt are crucial figures to take into account. And the percentage of the total debt that should be settled no later than within the following year.

Net Debt Example

Company XYZ’s balance sheet shows it has short-term debts of $100,000 and long-term debts of $75,000 across accounts payable, credit line balances and term loan balances. The company also has total cash and cash equivalents of $225,000. What is the company’s net debt?

- Short-term debt: $100,000

- Total debt: $75,000

- Cash and cash equivalents: $225,000

Now let’s use our formula and apply the values to calculate the net debt:

In this case, XYZ company has a net debt of -$50,000. Company XYZ’s net debt is a negative value, which is a positive result in terms of business. It means that the company has more than enough money to pay off its debts immediately if it has to. At the same time, this could mean that the business is unable to keep pace with other similar companies where debt is a critical part of their growth strategy.

This company could seek to use additional debt as leverage to grow its operations because of its healthy liquidity position.

Net Debt Analysis

Net debt is used as a sign of a company’s ability to settle all of its debts, should it have to pay them immediately with only cash or cash equivalents. These are assets that can be easily converted to cash anytime. This value also helps determine if a company is overleveraged or is buried in debt against its liquid assets.

With a negative net debt, as in the example provided, a company has more cash and cash equivalents than it needs to cover its financial obligations. As a result, it’s considered fiscally stable. Companies with negative net debt are usually believed to have a greater capacity to endure difficult economic conditions.

However, too little debt could be a bad sign. A company that isn’t investing in its development due to debt might have a hard time keeping up with long-term growth. But because some industries depend on having more debt than cash, investors should look at industry benchmarks.

For instance, oil and gas companies are capital-intensive businesses. Simply put, they need a large amount of capital to invest in large fixed assets, like property and equipment. This leads to businesses in the industry usually having considerable percentages of long-term debt dedicated to financing their oil rigs and drilling requirements.

An oil company might have a positive net debt figure, but if you look at this against other oil companies, you’ll see it as a standard. Comparing an oil and gas company’s net debt with that of an advertising company with low overhead wouldn’t make sense.

Net Debt Conclusion

- The net debt measures a company’s ability to pay off all of its debts if they were due immediately.

- This formula requires two variables: total debt, and cash and cash equivalents.

- The net debt is expressed as a monetary value.

- Net debt shows how much money will be left if a company paid all of its debts using its cash and cash equivalents.

- A negative net debt is usually better as it means it has more than enough cash to pay debts if necessary.

Net Debt Calculator

You can use the net debt calculator below to quickly calculate how capable a company is of paying off its debts immediately, by entering the required numbers.

FAQs

1. What is net debt?

Net debt is defined as a company's total liabilities minus its total cash and cash equivalents. It is used as a measure of a company's ability to pay off its debts immediately.

2. How is the net debt calculated?

Net debt is calculated by subtracting a company's total cash and cash equivalents from its total liabilities or long-term and short-term debts.

3. What is a good net debt?

Negative net debt is considered good as it indicates a company has more cash than it needs to pay its debts. However, too little debt can be a bad sign for a company's long-term growth prospects.

4. What is net debt free?

A company is considered net debt free when its total liabilities are zero. This indicates the company has no outstanding debts and can pay off all its liabilities immediately if necessary.

5. Does net debt include leases?

No, leases are not included in net debt calculations. Only a company's outstanding liabilities and cash and cash equivalents are considered.