The net debt to EBITDA ratio is a leverage metric that measures the amount of net income that is available to pay down debt before covering interest, taxes, depreciation, and amortization expenses.

Put simply, the ratio indicates how long a company will be able to repay its debt for if its net debt and EBITDA never changed. A negative result is usually obtained if a company’s debt is lower than its cash. This ratio is similar to the debt to EBITDA ratio, and the only difference is that with net debt to EBITDA, cash and cash equivalents are deducted from total debt as well.

When analyzing the net debt to EBITDA ratio it must be compared with a benchmark value or the industry average to make it useful for assessing the company’s capability of settling its debt.

In addition, a horizontal analysis, which involves looking into the company’s historical data, must be performed to know whether a company has added to or reduced its debt during a particular period, and how it has grown during the covered time frame.

Make sure you compare with companies in the same industry, as capital requirements vary and some industries, like manufacturing, are more capital intensive.

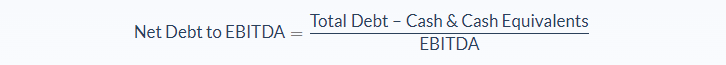

Net Debt to EBITDA Formula

First, we need to get the value of total debt by summing short- and long-term debt from the balance sheet.

Cash and cash equivalents are also found on the balance sheet, and these are deducted from the total debt.

EBITDA (earnings before interest, taxes, depreciation and amortization) might be found on the income statement depending on the company. If not, you can find EBIT (earnings before interest and taxes) on the income statement, and depreciation and amortization figures will be in the notes to operating profit or on the cash flow statement.

Net Debt to EBITDA Example

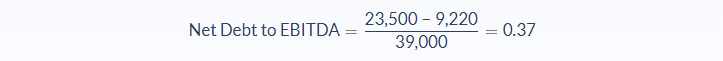

Lily Ament, an investor, would like to assess 123 Enterprises’ ability to pay off its debt. She digs into the company’s financial records and finds the following data for 2019:

- Short-term debt: $4,200,000

- Long-term debt: $19,320,000

- Total debt: $23,520,000

- Cash: $9,220,000

- EBITDA: $39,000,000

What is 123 Enterprises’ net debt to EBITDA ratio?

We can now apply the values to our formula and calculate the net debt to EBITDA:

In this case, the 123 Enterprises would have a Net Debt-to-EBITDA value of 0.37 for the year 2019.

A Net Debt-to-EBITDA ratio of .36 indicates that 123 Enterprises is highly likely to be able to pay its obligations and have lots of fiscal room to take on additional debt to help the company grow.

But Lily should not stop after checking the company’s 2019 data. Instead, she should go further back to analyze past years and look for trends. For example, if earlier ratios had been increasing consistently, it could be a sign that the company’s ability to pay off its debt is decreasing with each fiscal year, even if the current year’s ratio is still technically safe.

Net Debt to EBITDA Analysis

The net debt to EBITDA ratio is favored by analysts because it considers a company’s debt-clearing capacity. A low net debt to EBITDA ratio is usually desired as it shows that a business is not buried in debt and will be able to cover its financial obligations with ease. In contrast, a high net debt to EBITDA ratio is a sign that a company is too much in debt, which also means that its credit rating is low, and investors are likely to demand higher bond yields to buffer the greater risk that comes with lending it money.

Overall, the ratio is useful in decision-making, including decisions related to a takeover bid investment. Also, it’s helpful to potential buyers when in appraising the company’s profitability minus the current manager’s vigorous spending. If the company is conservative in its spending when branching out or buying new equipment, its depreciation and amortization costs will be lower, making it profitable without the said extra expenses.

Still, using the net debt to EBITDA ratio alone to measure a company’s debt payment ability can be a slippery slope. After all, a company can still overspend despite having a high EBITDA. This may even assume that the company’s revenues all come from its customers, thus leaving out uncollectible accounts receivable and customer returns. And, of course, a higher ratio increases a company level of risk as a potential borrower when banks or creditors assess them.

Net Debt to EBITDA Conclusion

- The net debt to EBITDA ratio shows how capable a company is to pay off its debt with EBITDA.

- This formula requires three variables: total debt, cash and cash equivalents, and EBITDA.

- The net debt to EBITDA ratio is usually expressed as a decimal number.

- The ratio is typically used by credit rating agencies when assigning companies’ credit ratings.

- A low net debt to EBITDA ratio is preferred and indicates that the company has a healthy level of debt

- A high ratio shows that the company has too much debt, possibly leading to a low credit rating and a higher bond yield requirement.

- A ratio higher than 5 should raise alarm.

Net Debt to EBITDA Calculator

You can use the net debt to EBITDA calculator below to quickly assess a company’s ability to pay off its debt, by entering the required numbers.

FAQs

1. What is the net debt to EBITDA ratio?

The net debt to EBITDA ratio is the calculation of a company's net debt divided by its earnings before interest, taxes, depreciation, and amortization. This number indicates how much earnings a company would have left over each year if it paid off all of its debts.

2. What is the formula to calculate net debt to EBITDA?

The formula to calculate net debt to EBITDA is total debt minus cash and cash equivalents divided by earnings before interest, taxes, depreciation, and amortization.

3. What can the net debt to EBITDA ratio tell you?

Net debt to EBITDA can tell you how capable a company is to pay off its debt with its EBITDA. A high net debt to EBITDA ratio may be an indication that a company is struggling to pay off its debts and could lead to a low credit rating. A low net debt to EBITDA ratio, on the other hand, is a sign that the company is in good financial standing.

4. What is a good net debt to EBITDA ratio?

A good net debt to EBITDA ratio is one that is low, indicating that the company has a healthy level of debt. A high net debt to EBITDA ratio is not as desirable and may be a sign that the company is struggling to pay off its debts.

5. What does the net debt to EBITDA ratio measure?

Net debt to EBITDA ratio measures how capable a company is to pay off its debt with its EBITDA. This number is useful when assessing a company's overall financial health and can be used by credit rating agencies when assigning credit ratings.