Operating cash flow margin is a profitability ratio that is used to measure the amount of cash made from operating activities of a company as a percentage of net sales in a given period. It determines how much of sales revenue is operating cash. It shows how efficiently a company is creating money out of its revenue. This is also a profitability index used by investors and other financial analysts.

Operating cash is the amount of money a company generates from its total revenue, minus costs associated with long term investment such as capital items and securities. To obtain operating cash flow, one must calculate the cash paid to the company by its customers, and the cash the company has paid to suppliers and production labour. The operating cash is the difference between the two.

Operating cash is more accurate at measuring the cash generated by companies than other profitability measures like net income and EBITA. Companies with fixed assets like factories will have decreased net income due to depreciation, whereas depreciation is a non-cash expense.

Net sales is the cash earned by a company in exchange for its goods or services. It is the cash earned before the deductions for the cost of goods sold. It is different from gross sales as gross sales include discounts offered, returns, and promos. Net sales is typically found on the income statement.

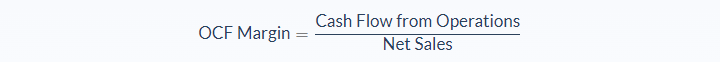

Operating Cash Flow Margin Formula

Operating cash flow margin is calculated by dividing cash flow from operations (or operating cash flow) by net sales. An increase in net sales would result in a decrease in the operating cash flow margin. On the other hand, an increase in the operating cash will increase the operating cash flow margin.

To increase the operating cash flow margin, the operating cash must be increased as much as possible while the net sales is held constant.

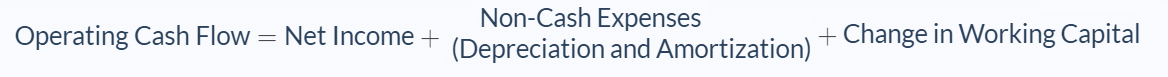

Cash flow from operations might be available to you from the company’s statement of cash flows, but if not it will need to be calculated manually.

The operating cash does not include deductions for non-cash expenses like depreciation, amortization, and others but does include changes in working capital. It can be calculated as follows:

Operating Cash Flow Margin Example

A bricklaying company, Aswac, wants to calculate its operating cash flow margin. Aswac sold 900,000 bricks at $6 each. From Aswac’s balance sheet, its net income for this year is $3,000,000. The total depreciation of its assets is $250,000. Amortization, on the other hand, totals $80,000. Other non-cash expenses total $50,000. Aswac also acquired two new bricklaying machines, each worth $15,000.

From the question we can calculate all three of the required variables, starting with operating cash and net sales. The net sales can be calculated by multiplying the number of bricks sold (900,000) by the price per brick (6). So the net sales would be $5,400,000.

We can calculate the operating cash using the formula given above. It should be noted that change in capital includes any addition to production assets. For Aswac, they added two new brick machines for $15,000 each.

To find the operating cash, we can add the net income ($3,000,000), depreciation ($3,000,000), amortization ($250,000), change in working capital ($80,000), and other non-cash expenses ($80,000).

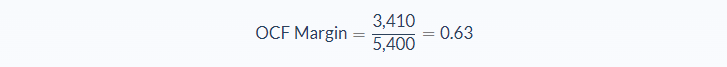

Now, we have both of our required variables.

- Operating cash flow = $3,410,000

- Net sales = $5,400,000

Now that we have all the data needed to calculate the operating cash flow margin we can substitute the values for the variables in the formula:

In this example, for every dollar made in net sales, $0.63 is operating cash. This means that the operating cash flow margin for Aswac is 63%. The operating cash flow margin of 63% is above 50%, which is a good indication that the company is efficiently creating operating cash from its sales.

Operating Cash Flow Margin Analysis

Operating cash flow margin is a metric that measures how well a company is converting sales into operating cash. This also gives insight into how the company is minimizing costs of production and other related expenses.

Company operations all rely on cash. Companies need to pay dividends, pay salaries, pay overheads and also buy assets. It is therefore vital that all companies pay close attention to their operating cash flow. A good cash flow margin means that the company is efficiently converting sales into operating cash, which can be used to pay shareholders or buy back stock. Operating cash flow margin is a key indicator of performance.

Investors examine operating cash flow seriously because a negative operating cash flow margin means that the company is losing money. It is not able to recover the cost of production of its goods. This means that the company is spending from its reserves. While this may happen for a while for a company, prolonged negative operating cash flow margin will result in the company exhausting its cash reserve and eventually going into debt to remain in business.

One way to improve operating cash flow margin is to conduct a timely cash drive to collect all accounts receivables. Though this might be tricky, as no company wants to lose its customers, however, the company can always work towards striking a balance so that customers pay on time.

Operating Cash Flow Margin Conclusion

- Operating cash flow margin is a measure of the cash a company makes from its operations as a percentage of its net sales in a given period.

- It is used by companies and investors to determine how efficiently the company is creating operating cash from its revenue.

- A negative operating cash flow margin is an indication that the company is not making any profit but rather losing money.

Operating Cash Flow Margin Calculator

You can use the operating cash flow margin calculator below to quickly calculate the operating cash flow of a company by entering the required numbers.

FAQs

1. What is the operating cash flow margin?

Operating cash flow margin is a metric that measures how well a company is converting sales into operating cash. This also gives insight into how the company is minimizing costs of production and other related expenses.

2. What is a good operating cash flow margin?

A good operating cash flow margin is typically above 50%. If a company has an operating cash flow margin of below 50%, this suggests that the company is not efficiently making sales into cash, and instead, may have high expenses.

3. What does a negative cash flow margin mean?

A negative cash flow margin is an indicator that the company is losing money. This might be due to high expenses, uncollected accounts receivable, or other factors.

4. How can the operating cash flow margin be improved?

One way to improve operating cash flow margin is to conduct a timely cash drive to collect all accounts receivable. Though this might be tricky, as no company wants to lose its customers, however, the company can always work towards striking a balance so that customers pay on time.

5. What is the difference between cash flow margin and operating margin?

Cash flow margin is a measure of the cash a company makes from its operations as a percentage of its net sales in a given period. Operating Margin on the other hand, measures profitability and efficiency of running day-to-day operations.