The Payback Period is the amount of time it will take an investment to generate enough cash flow to pay back the full amount of the investment. In predicting the payback period, you would be forecasting the cash flow for the investment, project, or company. You can then use the cash flow estimate how many payments need to be made to recover the initial investment.

But, as we know, cash flow is not always even from period to period, especially when we are talking about the income from an investment.

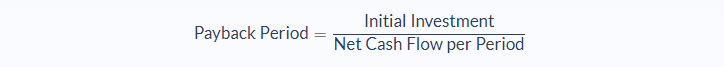

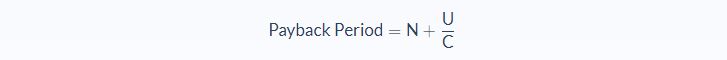

In the formula section below, you will notice two different formulas. If the periodic payments made during the payback period are equal, then you would use the first equation. If they are irregular, then you would use the second equation. Both of these formulas disregard the time value of money and focus on the actual time it will retake to pay the physical investment.

Payback Period Formula

In this formula, the net cash flow would be over the course of the set payback period. Also, in order to use this formula, the net cash flow must remain equal over each period of payments.

If the payments are irregular, you would instead use the following formula:

- N = Number of periods before investment recovery

- U = Amount of investment unrecovered at the start of the period

- C = Total cash flow during the final period

For the variable U, you would need to calculate the total amount of all periods where the total cash flow goes toward paying back the investment. Then you would subtract that amount from the total investment amount to find the unrecovered portion of the investment.

Payback Period Example

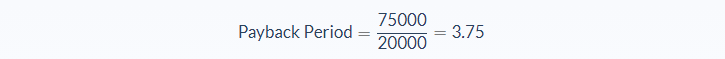

Here is an example of a Payback Period for regular payments:

Andy is a development coordinator at a media company and is in charge of putting together new programs. He is considering investing $75,000 in a promising new cooking show. But the company wants to make sure they are paid back for their investment within 4 years. The new show is expected to generate $20,000 per year. Will the show be able to make the required money back by the 4-year deadline? Should the company make the investment?

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Initial Investment (I): 75000

- Net Cash Flow (N): 20000

- Payback Period (P): Unknown

We can apply the values to our variables and calculate the projected payback period for the new series.

In this case, the cooking show would be able to make the money back in 3.75 years. If they invest, they would be making their money back 0.25 years early, which means that this would be a financially sound investment for the company.

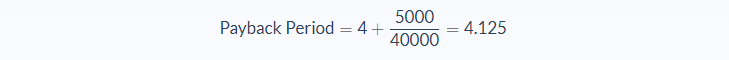

Here is an example of a Payback Period for irregular payments:

Andy has another show, a game show, he is considering for programming. The initial investment would be the same $75000 and it would have 5 years to return the investment. However, because of the unusual costs of the game, the payback amounts would be irregular. Here are the projected annual payments (respectively): $5000, 5000, $25000, $35,000, $40000. Will the show be able to make the required money back by the 5-year deadline? Should the company make the investment?

Here are the variables:

- Number of periods before investment recovery (N): 4

- Amount of investment unrecovered at the start of the period (U): 5000

- Total cash flow during the final period (C): 40000

- The payback period (P): Unknown

In this example, the game show would be able to pay back its investment in 4.125 years. Because it is under 5 years, this would still be a good investment.

Because of these formulas, Andy can now make confident decisions. He can feel secure about the future of the company and the potential of his investments. Additionally, since the show will be done paying back the initial amount early, they will be able to start generating an income on the shows sooner.

Payback Period Analysis

The Payback Period formula is a tool that can be incredibly useful for companies in projecting the financial risk of a project. In examining the results, you should be looking for the shortest possible payback period. Because then, you can start making money beyond your investment.

You can use the tool just to estimate how long a debt or investment will take to be paid off. However, if you are evaluating a future investment, it is a good idea to have a maximum Payback Period already set. How long are you willing to wait before the money is returned to you? Then you can more accurately compare and evaluate.

Like the examples above, companies can use this tool to estimate the risk of a new project. If a business owner wants to invest money in a new piece of machinery, they could use these formulas to estimate how long it would take the cash flow resulting from the equipment to recoup the initial losses.

Another great way to use this tool is when considering student loans. As a student is deciding on a degree, they can research the average income from a career with that degree. Using that number, along with the projected cost of their student loans, they can project how long it will take before they have recovered their investment.

Payback Period Conclusion

- The Payback Period is the time it takes an investment to generate enough cash flow to pay back the full amount of the investment.

- The Payback Period formula for even payments involves only two variables: the initial investment amount and the net cash flow of the investment.

- The Payback Period formula for irregular payments involves three variables: the number of periods before investment recovery, the amount of investment recovered at the start of the period, and the total cash flow during the final period.

Payback Period Calculator

You can use the Payback Period calculator below to quickly estimate the time needed to get a return on investment by entering the required numbers.

FAQs

1. What is the payback period?

The payback period is the time it takes an investment to generate enough cash flow to pay back the full amount of the investment. In this calculator, you can estimate the payback period by entering the initial investment amount, the net cash flow per period, and the number of periods before investment recovery.

2. How do I calculate the payback period?

To calculate the payback period, you need to know the initial investment amount, the net cash flow per period, and the number of periods before investment recovery. With these numbers, you can use the calculator above to estimate the payback period.

3. What is an example of a payback period?

An example of a payback period is the time it would take for a business to recover its investment in a new piece of machinery. With this information, the business can make an informed decision about whether or not to make the investment.

4. What is a good payback period?

There is no definitive answer to this question. It depends on the individual business and its specific needs. However, a good payback period is one that is short enough so that the investment can start generating an income sooner. This allows the company to reinvest that money and see a return on their investment quicker.

5. What are some of the downsides of using the payback period?

There are a few potential downsides to using the payback period. First, it does not take into account the time value of money. This means that a dollar today is worth more than a dollar tomorrow. Therefore, an investment with a shorter payback period might not be as good of a deal as it seems.