Petty cash is cash that is kept on the company premises by a company, it is normally a small amount kept for covering minor purchases. Larger amounts of cash will be kept in the company’s bank account.

Minor expense examples are office supplies, reimbursements, postage expenses, highway tolls etc. Let’s delve a little deeper.

Petty Cash Safeguards

Petty cash is the cash that is not immediately deposited into a bank account. The correct measurements need to be put into place to safeguard the cash against theft and fraud.

Petty cash is kept on-site in a locked drawer or safe and there is an overseer that has the authority to handle the cash. The overseer’s duties include enforcing all petty cash rules and regulations, requesting, replenishing and dispensing of funds.

Petty Cash Transactions

There are four types of transactions that typically go through petty cash:

- Petty cash creation: Petty cash is created by drawing money from the company’s bank account and handing it to the overseer of the petty cash fund. A journal entry to debit petty cash and to credit bank is made.

- Disbursements of petty cash: Individual payments from the petty cash fund are not recorded in the journal. You create a journal entry at the end of the period or when you replenish the fund.

- Replenishment of petty cash: Petty cash needs to be replenished when the cash balance is running low. A journal entry is passed to debit the different expenses and credit the petty cash for the total of disbursements. Thereafter, the petty cash will be replenished by withdrawing money from the bank.

- Raising Fund Level: If there is an increased amount of transactions that are paid by using petty cash then the petty cash fund level will need to be increased. The journal will debit petty cash and credit the bank.

The use of a petty cash fund circumvents certain internal controls. The availability of petty cash does not mean that it can be accessed for any purpose and by anyone.

Many companies employ strict internal controls to manage the fund. Often, limited individuals are authorized to approve disbursements and can only do so for expenses related to legitimate company activities or operations.

How does Petty Cash Work?

A company would estimate their weekly or monthly cash requirement and according to that, they will establish a limit that will be withdrawn from the bank account. This will be used to settle small cash payments from time to time.

A limit could be set to the fund that the overseer is not allowed to exceed without approval from management. Reimbursement of the fund will occur from time to time based on the company policy.

Petty Cash Receipt

Cash payments can not be controlled if there is no evidence that payment was made. A petty cash receipt needs to be issued every time the payment takes place.

Accounting of Petty cash

Petty cash transactions are recorded on the financial statements. Let’s look at the different entries for petty cash:

- Creating your petty cash — A petty cash fund is created by withdrawing money from your bank account and handing it over to the petty cash overseer.

- Disbursement of petty cash — Every payment out of the petty cash fund will not be journal as a single entry. A single journal entry will be added at the end of the day or after a period for the total payments made from the petty cash. The journal entry will contain the breakup of the total cash payments.

- Petty cash replenishment — If the petty cash balance is running low the cash will be replenished by adding money from the bank.

There are three different policies to keeping petty cash namely:

- Petty cash fixed float — The organization decides on a fixed amount that should always be available in the petty cash. If the amount nears the fixed float amount the petty cash needs to be replenished by requesting a withdrawal from the bank. This is the best petty cash policy according to accountants.

For example, the petty cash float is set at $250 and $100 was already spent. Bringing the petty cash balance to $150. The petty cash will have to be replenished with $100 to ensure that the minimum limit of $250 is kept.

- Petty cash as needed — Smaller companies have a policy where they will only withdraw petty cash when they need it. This policy reduces the risk of fraud or theft.

For example, the company has a delivery coming in at the end of the week. The overseer updates the petty cash with cash earlier the week to ensure that the delivery fees can be paid.

- Unorganised Petty Cash — There is no formal policy in place with regards to withdrawing money and there is no limit in the petty cash. From a control and risk perspective, it is less risky because the cash will be closely controlled by the owner. It should, however, be avoided from an accounting perspective.

Petty Cash Example

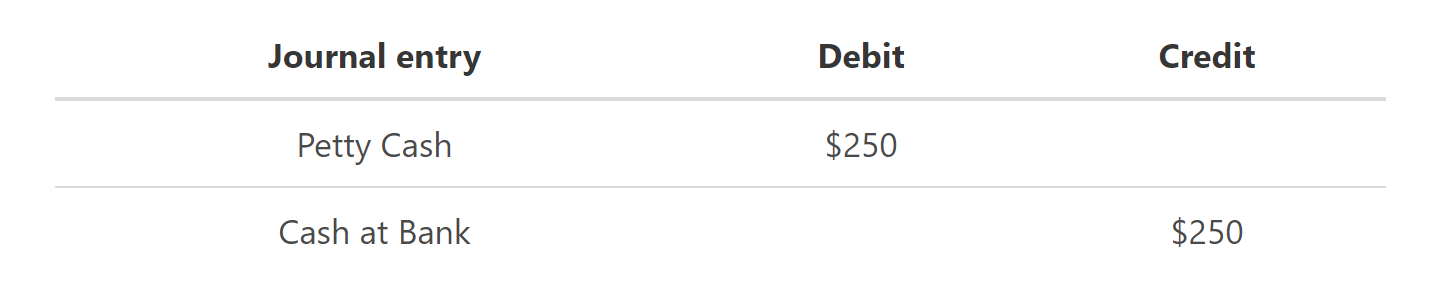

A company creates a petty cash fund of $250 on 1 July 2019. The journal entry is:

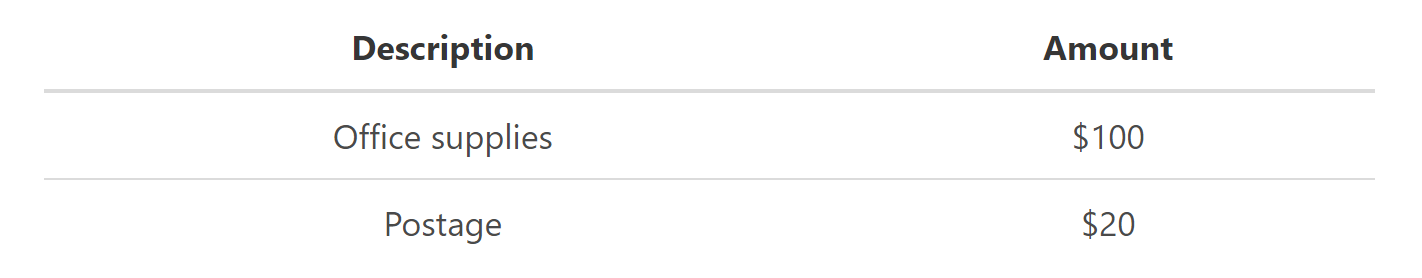

During July 2019 the following payments were made from the fund:

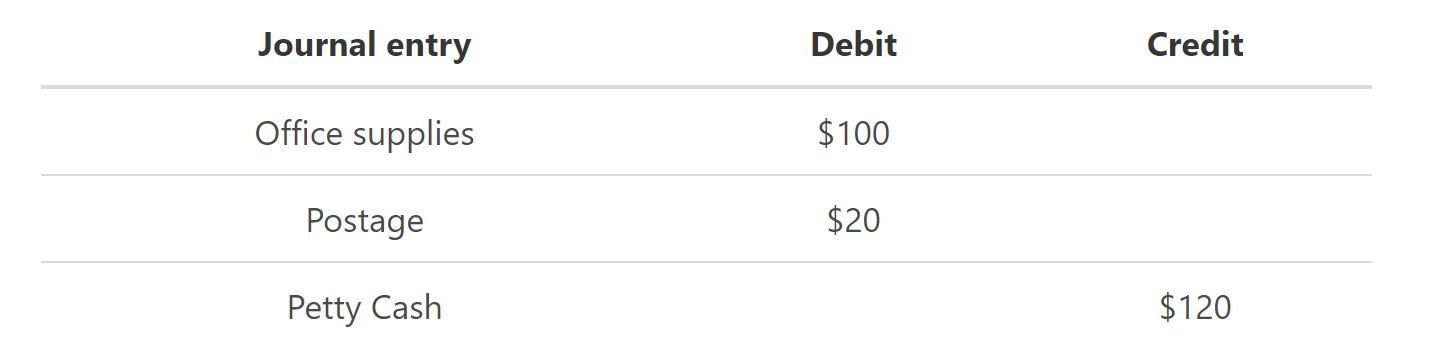

To record the disbursements from petty cash the below journal entry needs to be made:

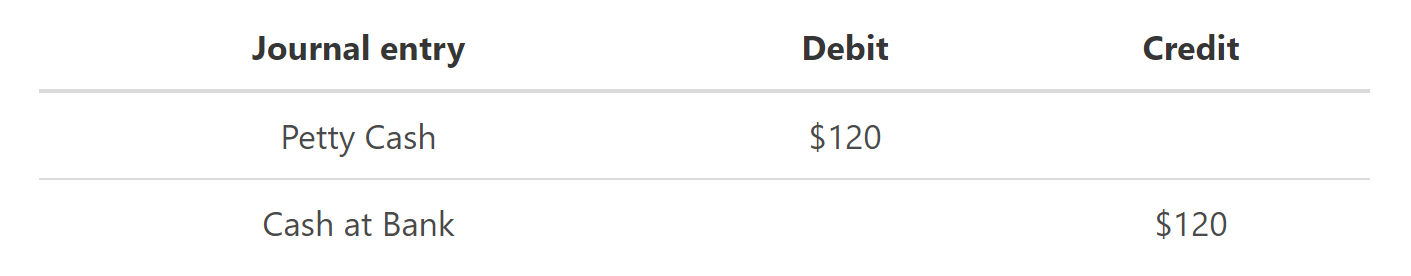

To replenish the Petty Cash fund the below journal entry should be made:

Petty Cash Conclusion

- Petty cash is small amounts kept for paying small expenses that would occur during normal operations.

- Petty cash is kept on-site in a secure drawer or safe. Petty cash needs to be safeguarded against fraud and theft.

- The four types of petty cash transactions are petty cash creation, disbursements, replenishment and raising petty cash funds.

- Petty cash will be estimated based on the company’s weekly or monthly cash requirements.

- A receipt needs to be issued every time a cash transaction takes place.

- Petty cash is accounted for with different entries:

- Creating petty cash will debit the petty cash account and credit the bank account.

- Disbursements are not added to the journal every time a payment is made. It is made periodically or when replenishment is made.

- Replenishment happens when the balance is running low. The different disbursements are debited per line and petty cash is credited. Then a second journal entry is made where petty cash is debited, and the bank is credited.

- The three petty cash policies are fixed float, as needed, and unorganized.

FAQs

1. What is petty cash?

Petty cash is a small amount of cash kept on-site to cover small expenses that would normally occur during the business. This could be anything from postage to office supplies..

2. What is an example of petty cash?

Examples of petty cash could include office supplies, postage, or parking fees.

3. What type of account is petty cash?

Petty cash is a current account and should be included in the company's financial statements.

4. What happens when petty cash doesn't balance?

If the petty cash doesn't balance, it means that there is more money going out than coming in. This needs to be corrected by either withdrawing cash from the bank or by making a journal entry to increase or decrease the amount of petty cash.

5. Why do businesses use petty cash fund?

A company might use a petty cash fund because it's more convenient and safer than carrying around large amounts of cash. It also allows for smaller payments to be made without having to go through the hassle of writing a check or transferring money.