The present value of an annuity due is the current worth of a series of cash flows from an annuity due that begins immediately. The payments from the annuity are distributed at the beginning of each period. This is very similar to finding the present value of an annuity with a few exceptions.

To understand the present value of an annuity due, you should first have a solid understanding of what an annuity is and the two types. An annuity is a sequence of payments that are made over a specific period of time.

In the first type of annuity, an ordinary annuity, payments are distributed at the end of the pay period. Alternately, in an annuity due the payments are made at the beginning of the pay period. But does this information really matter? How will it affect the final sum of the money invested?

It’s because the time value of money will affect the outcome of an annuity. The time value of money means that money you invested now would have a greater value than an equal amount of money invested in the future. Consequently, an annuity due will always be of greater value than an ordinary annuity (assuming everything else is equal). This makes the differences essential between formulas for finding the present value of an annuity and an annuity due.

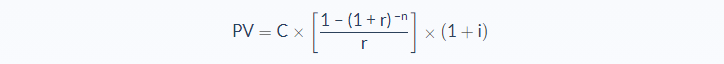

Present Value of an Annuity Due Formula

- C = cash flow per period

- r = interest rate

- n = number of periods

It’s important to remember that in finding the annuity due, the payments must begin immediately. Also, you will often see the interest rate referred to as a discount rate when discussing the present value of an annuity due. The interest rate can be a tricky variable when you are working through this equation.

Annuity payments can be sent out or required at different frequencies. They could be paid monthly, semi-annually, annually, etc. The type of interest rate that you use in the calculation should match the number of payments you are using in your equation. If you are being paid semi-annually, then you should be using a semi-annual interest rate in your calculation.

For example, if you have an annuity that would send monthly payments, and you have an annual interest rate of 12%, there would be a monthly interest rate of 1% in your formula.

Present Value of an Annuity Due Example

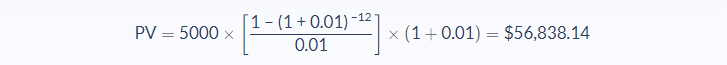

Mrs. Danielson is taking out a business loan requiring payments of $5000 at the beginning of each month for 12 months. The annual loan rate is 12%. Calculate the present value of the annuity due.

Let’s break it down to identify the meaning and value of the different variables in this problem. First, because the interest rate is annual but payments are monthly, the interest rate will need to be divided by 12. Hence, the rate we will use in our calculation is 1%.

- Number of Periods(n): 12

- Cash value of annuity payments per period (C): 5000

- Interest rate (r): 1% or 0.01

- Present Value of an Annuity Due (PV): Unknown

We can apply the values to our formula and calculate the present value of an annuity due based on her future payments.

Using this equation, the present value of the annuity Mrs. Danielson pays would be $56,838.14.

In this instance, understanding the present value of an annuity due would help Mrs. Danielson. She could see how the interest charged would ultimately affect her. This might help her to weigh out the cost versus benefit of a loan if she were considering taking one out.

If she had already taken the loan, this formula could help her to understand the urgency of wanting to pay it off at a faster rate to avoid the fees that come with the additional interest.

Present Value of an Annuity Due Analysis

Retirement planning is the most frequent use for needing to know the present value of annuity and annuity due. The differences in these types of investments are so important when you are facing retirement in your immediate future. This is especially true with the dependability of fixed interest rates. Understanding which type of annuity works best for your situation can give you both peace and power.

Still, there are a few more reasons for needing the present value of an annuity. You could also use this equation with your estate planning. Annuities are an attractive option for those who want their financial gifts to outlive them. Companies could use this calculation to better understand the value of the machinery they want to lease. Businesses or individuals could use this to better understand the present value on payments they need to make towards a loan.

If you are the one receiving the money from the annuity, then having an annuity due is better. If you are making the payments, then an ordinary annuity is better if the option is available to you. The value of the money will be higher with an annuity due because the payments come at the beginning of the month.

Present Value of an Annuity Due Conclusion

- The present value of an annuity due is a calculation that estimates the value of an investment that would begin right away based on future payments.

- All payments in an annuity due would be paid at the beginning of every pay period.

- The interest rates in your equation must match the frequency of the payments in your formula.

- The formula for the present value of an annuity due identifies 3 variables: the cash value of payments, the interest rate, and the number of payments.

Present Value of an Annuity Due Calculator

You can use the present value of an annuity due calculator below to work out the cash value of your immediate investment by entering the required numbers.

FAQs

1. What does the present value of annuity due mean?

The present value of annuity due is a calculation that estimates the value of an investment that would begin right away based on future payments.

This calculation considers the fact that all payments in an annuity due would be paid at the beginning of every pay period.

2. What is the formula for the present value of an annuity due?

The formula for the present value of an annuity due is

PV = C × [1−(1+r)−n] / r × (1+i)

where:

C = cash flow per period

r = interest rate

n = number of periods

3. What is an example of the present value of an annuity due?

An example of the present value of an annuity due would be a retired couple who receives a monthly payment from their insurance company.

The present value of that annuity would be the amount of money the couple would need to have saved up to receive those same payments each month.

The calculation would be:

PV = C × (1−(1+r)−n) / r × (1+i)

where:

C = the cash flow per period, in this case, $1000/month

r = the interest rate, in this case, 4%

n = the number of periods, in this case, 12

Thus, the present value of this annuity would be $47,471.84.

4. What is the difference between annuity due and ordinary annuity?

The difference between annuity due and ordinary annuity is that all payments in an annuity due would be paid at the beginning of every pay period, while all payments in an ordinary annuity would be paid at the end of every pay period.

Another difference is that the present value of an annuity due is always higher than the present value of an ordinary annuity.

5. What happens to the present value of an annuity when the interest rate rises?

When the interest rate rises, the present value of an annuity due falls, because the payments are spread out over a longer period.

Conversely, when the interest rate falls, the present value of an annuity due rises.