The present value of growing perpetuity is a way to get the current value of an infinite series of cash flows that grow at a proportionate rate. Put simply, it is the present value of a series of payment which grows (or declines) at a constant rate each period. Growing perpetuity can also be referred to as an increasing or graduating perpetuity.

The payments are made at the end of each period, continue indefinitely, and have a discount rate applied. This means that the total value of the perpetuity is infinite because the payments are ongoing and endless.

Even though the total value is infinite, the present value is finite. The further into the future the payment is, the lower the present value is. Why? Because of the time value of money concept, which states that a payment available at the present time is worth more than a payment in the future.

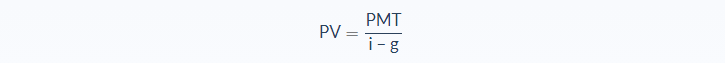

Present Value of Growing Perpetuity Formula

- PV = Present Value

- PMT = Periodic payment

- i = Discount rate

- g = Growth rate

The calculation for the present value of growing perpetuity formula is the cash flow of the first period divided by the difference between the discount and growth rates.

Present Value of Growing Perpetuity Analysis

This formula has a number of applications when investing in anything that is based on perpetuity. A few examples of why you might want to learn the present value of a growing perpetuity:

- Real estate. For an investor, the cash flow from rentals are infinite and will continue to grow over time. Using the above formula, you can assign a value to that.

- Common stocks. In theory, a company’s life is infinite. So, when an investor buys a stock, the dividend would be received in perpetuity and the present value can be calculated.

- Consols. Consols (also known as consolidated stock or annuities) were government-issued perpetual bonds. These have now been fully redeemed but are another example of how the formula can be used to work out the value.

Present Value of Growing Perpetuity Example

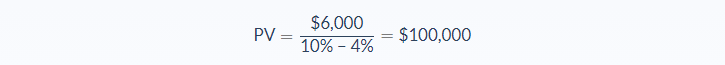

Elizabeth purchased a number of stocks in Apple. At the end of the first period, she received a payment of $6,000, which grows at a rate of 4% per year and continues forever. The discount rate is 10%.

Let’s use the formula from before to calculate the present value of Elizabeth’s growing perpetuity:

This means that the present value of the stocks Elizabeth purchased is $100,000. This is useful for Elizabeth because she can compare the present value of the perpetuity to the amount she paid for the stock. If the present value is high than she paid, it was a wise investment for her.

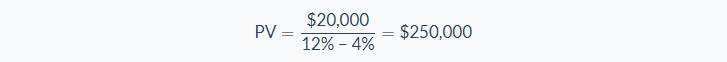

Let’s take a look at an example where an investor is deciding whether to make an investment into a new business. The cash flow payments will be $20,000 a year with a 12% discount rate. The cash flow payments are expected to grow by 4% every year, indefinitely.

This means that the investor will be profitable if they pay less than $250,000 for the new business.

Present Value of Growing Perpetuity Calculator

You can use the present value of growing perpetuity calculator below to work out your own present value using the required formula inputs.

FAQs

1. What does the present value of growing perpetuity mean?

The present value of growing perpetuity is a constant stream of cash flows that grow at a proportionate rate. This means that the present value is infinite because of the growing rate of payments.

2. What is growing perpetuity?

A growing perpetuity is an infinite cash flow pattern where the interest rate applied is greater than zero.

3. What is an example of growing perpetuity?

An example of a growing perpetuity is residential real estate. The rent payments are constant and increase every year by the same percentage, which means that it has infinite value because of the continued cash flow received.

4. How do you calculate the present value of growing perpetuity?

The present value of a growing perpetuity is calculated as the first cash flow divided by (i-g).

The formula is:

PV = PMT / i−g

where:

PV = Present Value

PMT = Periodic payment

i = Discount rate

g = Growth rate

5. What is the present value of perpetuity?

The present value of a perpetuity is based on two factors: cash flows and interest rate. Cash flows are the payments you get, and interest rate is the discounting factor.