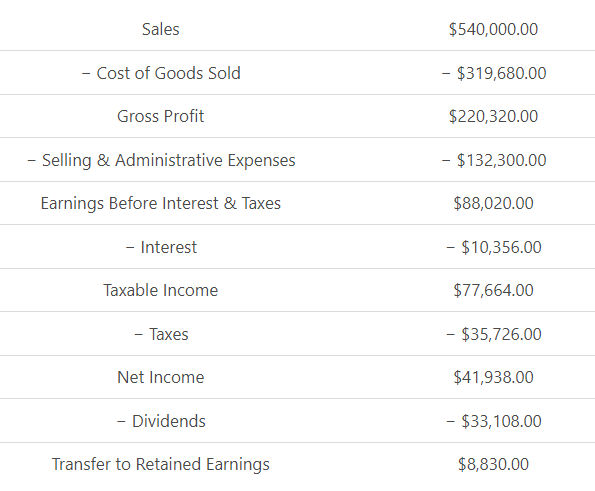

The profit and loss statement (also known as the income statement) shows a firm’s revenues, expenses, and taxes associated with those expenses for a financial period.

Where the balance sheet may be thought of in terms of the “left–right” orientation previously discussed, the income statement would be thought of in “top–down” terms.

A basic overview of the income statement items above shows how a manufacturing company might present an income statement. Income statements for other companies may appear to be slightly different, but in general, the construction would be the same.

An important concept in understanding the income statement is Earnings Per Share (EPS). The EPS for a company is net income divided by the number of shares of common stock outstanding. It represents the bottom line for a company.

Companies continually make decisions on how their bottom line will be impacted since shareholders in the company are concerned with how management decisions affect individual shareholder position.

FAQs

1. How do I prepare a profit and loss statement template?

There are several ways to do this, and the specific approach you take will depend on the type of business you run and the accounting software you use. Generally, you can create a profit and loss statement template in Excel using formulas to calculate your revenue, expenses, and net income.

The excel template is already set up with the formulas. You just need to enter your revenue and expense data to get started.

2. Can I do my own profit and loss statement?

Yes, you can pull together your own statement and create the document using a spreadsheet. Tools like Excel and Google Sheets make it easy to do this. You can also find profit and loss templates online that you can use as a guide.

3. Is there a profit and loss template in Excel?

Yes, there is a profit and loss template in Excel that you can use to create your own statement. The template includes formulas to calculate revenue, expenses, and net income. You can enter your own data to get started.

4. What are the 3 sections of a profit & loss statement?

The 3 sections of a profit and loss statement are:

· Revenue – This is the total amount of income generated by your business over a certain period.

· Expenses – This is the total amount of money you’ve spent on running your business, including things like employee salaries, rent, and supplies.

· Net Income – This is the amount of money you’ve earned after subtracting your expenses from your revenue. This is your profit or loss for the period.

5. What is the difference between a profit and loss statement and a balance sheet?

The profit and loss statement shows how much money your business has earned or lost over a certain period of time. The balance sheet shows the financial position of your business at a specific point in time. It lists your assets, liabilities, and equity.

Let's say you are the owner of a business that has been in operation for one year. Your balance sheet at the end of the year would show what your business' assets, liabilities, and equity were at that point in time. The profit and loss statement for the year would show how much money your business earned or lost over the course of the year.