A return on investment (ROI) is an evaluation of how profitable an investment is compared to its initial cost. The ROI can help to determine the rate of success for a business or project, based on its ability to cover the invested amount.

It is important to point out that finding the return on an investment is not the same as calculating a company’s profit. Evaluating profit alone looks solely at a company’s cash flow. This is a demonstration of their immediate performance. Net profit would look at the income acquired after expenses are taken out. The return on the investment then takes that net income and measures it against the total cost of the financing.

An ROI can be helpful when comparing an investment against other opportunities or investments on the market. It is also a great way to analyse the success of an investment you’ve made. Typically, the riskier an investment, the more potential it has for a better ROI.

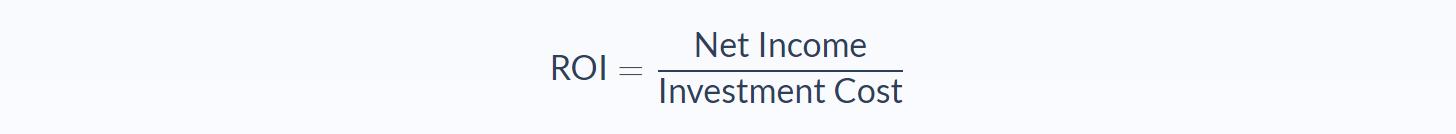

Return On Investment Formula

Essentially, the ROI formula takes the financial gain and divides it by the cost. Within the formula, you will notice that the net income is a required piece of information. To calculate the net income, you look at the cash flow from investment minus cost of expenses.

The ROI does leave some room for interpretation, which can be both positive and negative. In some ways, it can help you focus on the rate of return that matters to you. However, it can be misleading if you are not clear and consistent with your information. For example, one version of an ROI might use only the investment as the cost in calculating your net income. Whereas, another version might also include the cost of time spent on the project as well.

As a result, calculations can vary greatly, painting different pictures of an investment’s health. To provide more consistent results, use the same information from calculation to calculation, and be transparent about the information you included in your rate.

Mostly, the results of an ROI are expressed as a percentage. This makes them easier to understand and to use in comparisons. If you need to include this in your calculation, you would simply multiply your result by 100. An ROI does not include the time it took to recover invested cash flow. It also does not take into consideration the time value of money.

Return On Investment Example

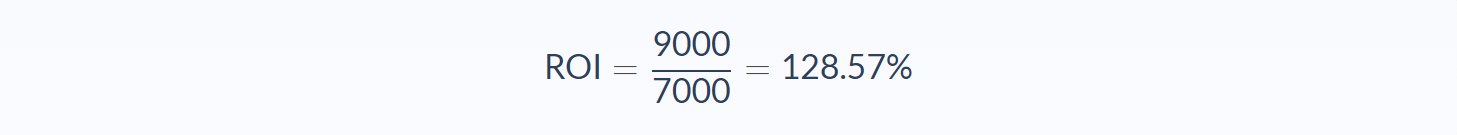

Maria is the marketing manager for her company. Last year, she put $7000 towards an ad campaign to advertise a new product. She is planning another campaign, but she wants to know the return on the investment that the company made during the first campaign so she can make adjustments. After expenses from the campaign, the company made a net profit of $9000 directly related to the campaign’s efforts.

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Net Income: 9000

- Cost of the Investment: 7000

We can apply the values to our variables and calculate return on investment.

In this case, the return on the investment would have a 1.2857 or 128.57% ROI.

Because of these formulas, Maria can see that her new campaign was a fairly good investment since it was able to generate income above the investment. She can also look at this rate of return against the period of time, one year. Depending on how fast she would need to recoup the investment, she might need to make some changes to her next campaign strategy. But whatever she chooses, she now has valuable information at her fingertips.

Return On Investment Analysis

While the return on investment formula provides helpful information about the viability of a project or investment, it does not necessarily tell us everything we need to know. There are other calculations that can be paired with the ROI formula to give a better status update on an investment.

If you want to account for the time value of money, you might want to calculate for the net present value, which determined the ROI based on the future value of income. Or, you could look at the annual rate of return, which looks at the ROI of competing investments over different periods.

Since the ROI is so flexible and requires such limited information, it is a very versatile tool. You can use it to analyze many different situations. For example, a small business owner could use it to calculate the profitability of a new machine purchase. A homeowner could project the ROI on a home improvement project, comparing it to the value it would add to the home. A stockholder might use the ROI calculation to evaluate two different companies while deciding which stock to invest in.

On the other hand, an investment’s ROI only looks at the financial prosperity of a project. There can be many other factors that can affect the “success” of an investment. As an example, a company might invest in strategies to improve employee satisfaction. Or they might put money toward a campaign to communicate company values.

Projects like these may not produce a clear ROI. However, they will have other important benefits. Employee satisfaction might improve their longevity, reducing turnover and costs. Updating your brand can improve clarity and customer loyalty, leading to more sales later on. Still, the ROI can provide a good foundation for understanding the current condition of an investment.

Return On Investment Conclusion

- The return on investment is an evaluation of how profitable an investment is compared to its initial cost.

- The return on investment is an analytic tool that helps investors understand how successful a business or project is (or has the potential to be).

- The return on investment formula takes two variables into account: the net income and the cost of the investment.

- The result of a return on investment calculation is usually written as a percentage.

Return On Investment Calculator

You can use the return on investment calculator below to quickly discover the efficiency of an investment by entering the required numbers.

FAQs

1. What is a Return On Investment (ROI)?

Return on investment (ROI) is a calculation that tells you how profitable an investment is, compared to its initial cost. The ROI can help to determine the rate of success for a project or investment.

2. How do you calculate the Return On Investment (ROI)?

The formula for calculating return on investment is: RO = Net Income / Investment Cost

3. What is a good Return On Investment (ROI)?

In general, an annual ROI of approximately 7% or greater is considered good. This is also known to be the threshold at which most investments are likely to be considered a wise decision.

4. What are the limitations of the Return On Investment (ROI)?

While the ROI is a helpful calculation, it does have some limitations. For one, the ROI does not always consider important factors such as time value of money or opportunity cost. Additionally, the ROI calculation may not be suitable for all types of investments. For example, a company might invest in employee satisfaction, even though it may not have a clear ROI.

5. Why is the Return On Investment (ROI) important in business?

ROI is important because it helps investors and business owners understand how successful a project or investment has been (or has the potential to be). The ROI calculation considers both the net income and the cost of the investment, making it a versatile tool for evaluation.