Return on retained earnings (RORE) is a ratio that shows how much a company earns those who own shares in the company (shareholders) by reinvesting the profits back into the company. The return on retained earnings is shown as a percentage.

The return on retained earnings allows investors to see if the company is being efficient with the money it is reinvesting and evaluate the company’s potential for growth.

A high RORE shows that the money should be reinvested in the company to assist with further growth. If there is a low return on retained earnings it means the company should be paying out dividends of profits to the shareholders instead of investing it back into the company.

A low return on retained earnings also means that the money being reinvested is not producing much additional growth. The money can be put to more use by attempting to attract new investors and keeping the current shareholders happy with their payments.

To start evaluating the return on retained earnings find the company’s annual report or look at the historical earnings press releases and follow the steps below to see how to calculate the RORE ratio. This information can often be found on a company’s website. Other places may include the U.S. Securities and Exchange Commission (SEC) EDGAR database.

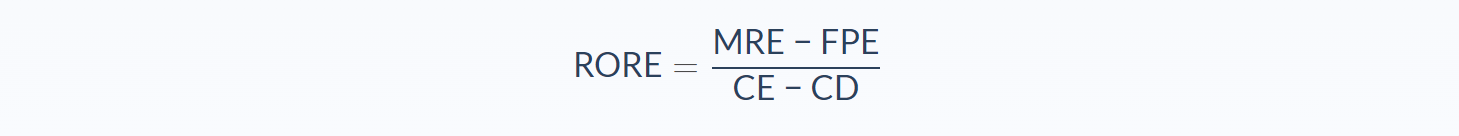

Return on Retained Earnings Formula

- MRE = most recent earnings per share (EPS)

- FPE = first-period earnings per share

- CE = cumulative earnings per share for the period

- CD = cumulative dividends paid to shareholders for the period

There are a couple of different ways to calculate the RORE. The best and simplest way to calculate the return on retained earnings is by using publicly published information about the earnings per share (EPS) over a period of your choosing. For the sake of the example below the period, we will be calculating the return on retained earnings over five years.

First, find the sum of all the EPS over the period you want to evaluate. Then find the sum of all the dividends paid to the shareholders during that same time. Subtract the cumulative dividends paid from the cumulative EPS. This number will be your denominator.

Second, find the difference, or growth/loss over time, in the EPS from the beginning to the end of the period. Divide this answer by the answer from step one. The end value will be shown as a percentage.

Return on Retained Earnings Example

OWL, Inc. paid a 1% dividend to shareholders over the last five years and the EPS has been progressively increasing. James wants to see if OWL still has the potential for growth by calculating the return on retained earnings. He adds up the last five years of EPS ($1.00, $1.30; $1.50; $1.70; and $2.00)

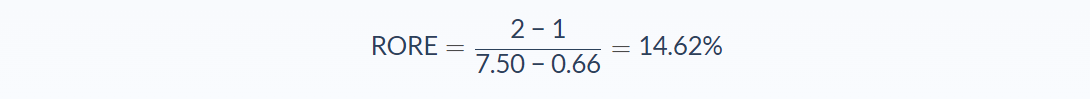

James then adds up the yearly dividend paid during those same five years ($0.01; $0.13; $0.15; $0.17; and $0.20) James uses the formula below to find OWL, Inc.’s return on retained earnings over the last five years.

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Most Recent EPS = $2.00

- First Period EPS = $1.00

- Cumulative EPS for Period = $7.50

- Cumulative Dividends Paid for Period = $0.66

Now let’s use our formula: RORE % = (Most Recent EPS – First Period EPS) / (Cumulative EPS for Period – Cumulative Dividends Paid for Period)

We can apply the values to our variables and calculate the return on retained earnings.

In this case, the return on retained earnings would be 14.62%

James can see that the return on retained earnings is a little under 15%. He compares that with other companies in the sector. OWL, Inc. is generating a pretty good RORE. James likes the continued growth potential for the company.

Return on Retained Earnings Analysis

James feels that nearly a 15% return on retained earnings is very good. If looking for a stock with steady growth, it is good to find one that is generating more earnings each year with the money that is being held back from shareholders.

A shareholder can be happy with a 1% dividend like OWL, Inc. has paid, so long as there are still gains on the shares even if they seem small. In a market where a bondholder only yields a 5% return, the 1% dividend along with the 15% return on retained earnings that produced a 50% increase in EPS over five years is much more attractive.

The important thing to remember is that the return on retained earnings is relative to the business and its competitors. If a different company in the same sector is producing a lower return on retained earnings, it does not always mean that it is a bad investment. It might mean the company is older and no longer in a growth stage. With a company like this, it would be better to see a lower RORE and higher dividend payout.

Return on Retained Earnings Conclusion

- The return on retained earnings is a ratio that shows how much a company earns shareholders by reinvesting profits back into the company.

- The formula for return on retained earnings requires 4 variables: Most Recent EPS, First Period EPS, Cumulative EPS for Period, and Cumulative Dividends Paid for Period.

- RORE is relative to the business and its competitors.

- A high RORE means the company should invest back into itself.

- A low RORE means the company should be paying out dividends to attract new investors because the reinvested money is not helping the company grow.

Return on Retained Earnings Calculator

You can use the return on retained earnings calculator below to quickly calculate the return on retained earnings by entering the required numbers.

FAQs

1. What are Return On Retained Earnings (RORE)?

The return on retained earnings is a ratio that shows how much a company earns shareholders by reinvesting profits back into the company.

2. How do you calculate the Return On Retained Earnings (RORE)?

The return on retained earnings is calculated by taking the most recent EPS and subtracting the first period EPS. The result is then divided by the cumulative EPS for the period minus the cumulative dividends paid for the period.

3. What is a good Return On Retained Earnings (RORE)?

A good return on retained earnings is anything over 10%. This means the company is making more money with the reinvested profits than they are paying out in dividends.

4. Which is a better Return On Retained Earnings (RORE), high or low?

A high RORE is better because it means the company is making more money with the reinvested profits than they are paying out in dividends. This allows for continued growth potential. A low RORE is worse because it means the company is not making as much money with the reinvested profits as they are paying out in dividends.

5. What does the Return On Retained Earnings (RORE) show you?

RORE shows you how much a company is earning shareholders by reinvesting profits back into the company. It is relative to the business and its competitors. A high RORE means the company should invest back into itself, while a low RORE means the company should be paying out dividends to attract new investors because the reinvested money is not helping the company grow.