The trial balance is a report that lists the balances of all the individual T-accounts of the general ledger at a specific point in time.

This is perhaps one of the simplest steps of the accounting cycle as it just requires the bookkeeper to compile the separate balances into one report.

There are two types of trial balance – an unadjusted trial balance and an adjusted trial balance. The difference between the two is that the unadjusted trial balance is prepared before adjusting entries and the adjusted trial balance is prepared after adjusting the entries. This is the only major difference as all the other steps required to create the trial balance are usually the same. They are also in similar formats.

Purpose of a Trial Balance

A trial balance serves the following purposes:

- Detection of any errors: The totals of debit column will not match the total of credit column if there has been an error in recording or posting any journal entry up till this point.

- Management use: It is usually used internally and is not for official distribution outside the company. The company can use this report to evaluate at a high level the financial position of a company. It will help address some questions like how much cash is available, the situation with debtors and creditors, total expenses paid etc.

In its initial form, this report will not be suitable to be used for preparing the financial statements like Income statement or Balance sheet as it will not comply with the accounting standard frameworks like US GAAP or IFRS. This trial balance will be prepared once again after all adjusting entries have been posted and then that report will be called an adjusted trial balance. Therefore, the unadjusted trial balance will serve as a foundation upon which the rest of the steps of the accounting cycle will take place on.

Preparation of the Trial Balance

An adjusted trial balance will have three columns (account names, debit, and a credit column) and will look just like an unadjusted trial balance. Like an unadjusted trial balance, it will have accounts listed in order of either their account numbers or in the order they appear on the balance sheet.

It is a common practice to list the account names in the order they appear on the general ledger of by their respective account numbers. Most accounts are numbered in the order they are displayed on the balance sheet. This means that assets accounts would come first, followed by liabilities and equity accounts and then ending with the revenues and expenses accounts.

Totals of both the debit and credit columns will be calculated at the bottom end of the trial balance. These columns should balance, otherwise, it would likely mean that there has been an error in posting of the adjusting entries.

The trial balance should have a proper header that should be in a similar format as below:

Company A

Unadjusted Trial Balance

January 21, 2020

There are two ways to prepare an adjusted trial balance.

The first method is to recreate the t-accounts but this time to include the adjusting entries. The new balances of the individual t-accounts are then taken and listed in an adjusted trial balance. This means repeating the accounting cycle again.

Another simpler way is to add the adjustment amount for the accounts that have been changed directly to the unadjusted trial balance. There is no need to list down accounts in the adjusted trial balance that have a zero balance. Only those accounts that will appear on the financial statements need to be listed.

Errors Detected by a Trial Balance

If the totals of debit and credit columns of the trial balance do not balance, one of the following errors might have occurred:

- A debit amount is erroneously posted as a credit amount or vice versa.

- The balances of the t-accounts are incorrect.

- The debit and credit columns of the trial balance have been totaled wrong.

- One or more of the individual ledger account balances have not been listed in the trial balance report.

- Duplication in the listing of one of the individual account balances.

The above are the most common errors that occur due to which the trial balance does not balance. However, this is not an exhaustive list and there are a variety of other factors due to which the mismatch occurs.

Errors Not Detected by a Trial Balance

There can be a situation where the bookkeeper has made multiple errors in either of the preceding steps of the accounting cycle, but the trial balance still balances. This could be due to a variety of factor as identified below:

- Error of omission: A journal entry for a transaction has been completely missed out on.

- Principle error: A transaction has been incorrectly journalized. For instance, a payment of rent could have treated as a payment for office supplies.

- Error of original entry: Both the debit and credit amounts of the journal entry have been overstated. Another situation exists where both the debit and credit amounts of the journal entry have been understated.

- Error of reversal: When the amounts are correct, but the account that should have been debited has been credited and the account that should have been credited has debited.

- Commission error: An incorrect account has been debited or credit. This is same as principle error in its nature. Principle error occurs due to a lack of accounting knowledge whereas a commission error occurs due to mistake or oversight.

- Duplication in the listing of multiple of the individual account balances.

Therefore, it is safe to say that when a trial balance is balanced, an error might or might not exist. If the trial balance does not balance, an error most unquestionably exists.

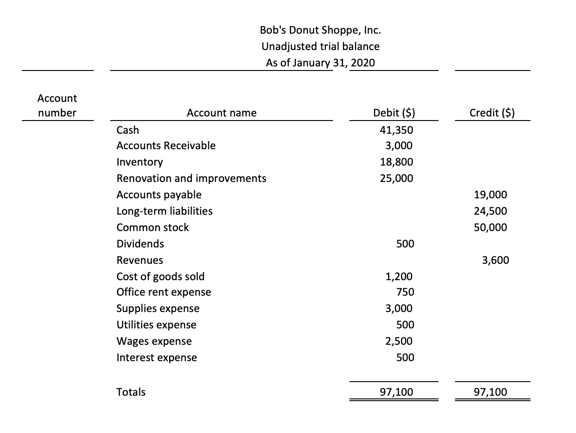

Bob’s Donut Shoppe Example

Bob and his company’s unadjusted trial balance for the given period is given below:

As you can see, the totals of the debit and credit columns balances. However, this doesn’t mean that there are no errors. The bookkeeper will still need to examine the accounts thoroughly again before proceeding to the next step of creating adjusting entries for the period.

FAQs

1. What is a trial balance?

A trial balance is a list of all the ledger account balances as of a certain date. The trial balance is used to determine if there are any errors in the bookkeeping process that need to be corrected. If the trial balance does not balance, it indicates that an error has been made.

2. What is the formula of trial balance?

The trial balance formula is total debits = total credits. This equation ensures that the total of the debit column matches the total of the credit column. If they do not match, it indicates that an error has been made.

3. What does a trial balance include?

A trial balance includes the balances of all the ledger accounts. These account balances are as of a certain date and are used to determine if there are any errors in the bookkeeping process. If the trial balance does not balance, it indicates that an error has been made.

4. Why is it called trial balance?

The trial balance is so named because it is used as a test to determine if the debits and credits are in balance. If they are not in balance, it indicates that an error has been made.

5. What is the difference between trial balance and balance sheet?

The trial balance is a list of all the ledger account balances as of a certain date. The balance sheet, on the other hand, is a snapshot of the financial position of a business as of a certain date. It shows the assets, liabilities, and equity of the business.