Adjusting entries are journal entries (which is why they are sometimes called adjusting journal entries) that are made at the end of the financial reporting period to correct the accounts for the preparation of financial statements. They are used to implement the matching principle, which is the concept to match the revenues and expenses to the “right” period.

- Revenues are recorded when they are earned, not when the money has been received

- Expenses are recorded when they were incurred, not when they were paid

The Accounting Cycle Example

Throughout this series on the accounting cycle, we will look at an example business, Bob’s Donut Shoppe, Inc., to help understand the concepts of each part of the accounting cycle. Below is the complete list of accounting cycle tutorials:

- Journal Entries

- T-Accounts

- Unadjusted Trial Balance

- Adjusting Entries (you are here)

- Adjusted Trial Balance

- Preparing Financial Statements

- Accounting Worksheet

- Closing Entries

- Income Summary Account

- Post-Closing Trial Balance

- Reversing Entries

We also have an accompanying spreadsheet which shows you an example of each step.

Click here to download the Accounting Cycle template

Types of Adjusting Entries

The three types of adjusting entries are given below:

- Prepayments

- Accruals

- Non-cash expenses

Each of the above adjusting entries is used to match revenues and expenses to the current period. Imagine Company XYZ takes out a bank loan in October 2018 and the first repayment occurs after six months in April 2019. The company prepares its financial statements in December 2018 and needs to account for the interest expense due for the two months, November 2018 and December 2018. Although the total interest expense will not be paid until April 2019, the company must still accrue the two months interest expense as it is incurred in the current reporting period.

This is also called accrual accounting. The methodology states that the expenses are matched with the revenues in the period in which they are incurred and not when the cash exchanges hands.

Why are Adjusting Entries Necessary

For each category of adjusting entry, we will go into detail and investigate why these are necessary to make at the end of the accounting cycle.

Prepayments

This category would include both prepaid expenses and unearned revenues.

Prepaid expenses include goods or services that a company has paid for but not utilized yet. Insurance is a good example of a prepaid expense. These are prepaid for a minimum of six months. However, the company cannot take full benefit of it until the end of that six-month period. At the end of the accounting period, only expenses that are incurred in the current period are booked while the remaining is recorded under prepaid expenses.

Unearned revenue is payment from the customer for services which have not yet been rendered. Therefore, in a sense, the company owes the customer and must record this as a liability for the current period rather than an income. In the next accounting period, once services have been provided to the customers for the advance payment, the company can go on to book this as revenue.

Accruals

On many occasions, a company will incur expenses but won’t have to pay them until the next period. For instance, utility expenses for December would not be paid until January. It must be booked in December irrespective of when the actual cash is paid out. Therefore, in the accounting books at the end of December, utility expense for one month is shown as a liability due.

Revenue can be accrued as well if a sale is made on account and the customer has not paid yet. For example, in December, a company makes a sale to a customer and gives him a three-month credit period to pay in full. Therefore, in the accounting books at the end of December, sales revenue would be recorded despite not being paid for.

Non-Cash Expenses

Adjusting entries are also used to record non-cash expenses such as depreciation, amortization, etc. These are paper expenses for which there is no cash outlay. They are recorded at the end of the accounting period and closely relate to the matching principle.

Recording Adjusting Entries

There are three simple steps required to record an adjusting entry:

- Determine the current balance of the account

- Determine what the balance should be

- Create adjusting entry to record the difference

These adjusting entries are created in the general journal, posted to their respective t-accounts and then to the accounting worksheet in the subsequent step of the accounting cycle.

Adjusting Entries Example

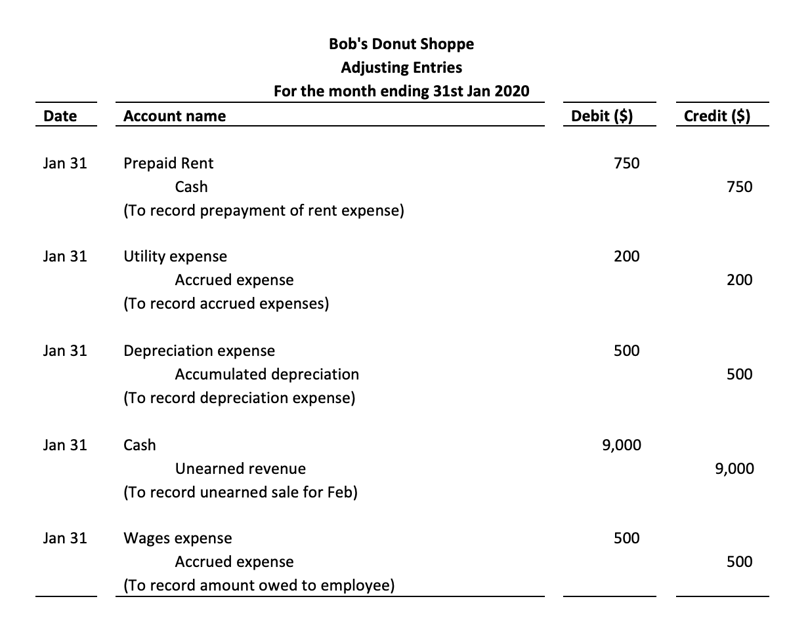

Continuing with our example of Bob and his company, Bob’s Donut Shoppe, Inc., we need to adjust his unadjusted trial balance at the end of the accounting cycle.

In Bob’s case, he likes to prepare financial statements on a monthly basis. The following are some of the month-end events for which he would like to make adjusting entries for:

- Bob pays his February rent of $750 in January.

- Bob’s gas utility expenses of $200 for January is due on 10th February.

- Bob’s improvement depreciation is $500 for the month.

- On January 31st, a customer pre-books and pays in advance for 300 boxes of donuts at $30 per box for delivery in February.

- One of Bob’s part-time employee works half a pay period; therefore, Bob accrues him $ 500 wages for the month. Bob pays this specific employee on the 15th of every month.

Important Points to Remember

There are two key points to highlight as a summarizing note for when adjusting entries are necessary:

- A certain revenue or expense has incurred in the given month, but no transaction has been recorded to book that amount. Therefore, an adjusting entry will be passed to include it in this period’s income statement and balance sheet.

- Something has been recorded, but the amount needs to be divided into two or more periods. This would also include cash received for services not rendered yet or cash paid for expenses not incurred yet.

An adjusting entry will always reflect on the:

- Income statement account (Insurance expense, Interest expense, revenue, etc.)

- Balance sheet account (Prepaid insurance, interest payable, accounts receivable, etc.)

Next Step

After all adjusting entries have been recorded, the company moves on to prepare an adjusted trial balance.

FAQs

1. What is an adjusting (journal) entry?

Adjusting entries are journal entries made at the end of an accounting period to correct the books for any accruals or deferrals that have taken place during that period.

2. What are examples of adjusting entries?

Some typical adjusting entries might include accruing revenue that has been earned but not yet received or recording a prepaid expense that will be used up in the near future.

Another common example is depreciation, which is a non-cash expense that must be accounted for in the period it was incurred.

3. What are the types of adjusting entries?

There are three types of adjusting entries:

-Accruals: recording revenue that has been earned but not yet received, or expenses that have been incurred but not yet paid.

-Prepayments: recording expenses that have been paid in advance, or revenue that has been received in advance of when it will be recognized.

-Non-cash expenses: such as depreciation, which is a deduction from the value of an asset over its useful life.

4. What is the purpose of adjusting entries?

Adjusting entries are necessary to ensure that the financial statements presented are accurate and in accordance with Generally Accepted Accounting Principles (GAAP). It is also used to convert cash basis accounting to accrual basis accounting.

5. Who needs to make adjusting entries?

All entities that use accrual basis accounting need to make adjusting entries in order to correctly reflect the financial position of the company. This includes for-profit businesses, not-for-profit organizations, and governments at all levels.