A business event is a business transaction in which there is an exchange of value between two groups. It is usually called an event when the transaction affects the accounting equation.

So, for example, if a customer buys goods on credit from Company A, this will be recorded as an increase in a sale for the company. The owner’s equity side in the accounting equation will increase through the increase in revenue account, and the assets side of the accounting equation will also increase as the accounts receivable account increases (goods purchased on credit).

A business event is anything that changes the information presented on the financial statements. The event is recorded in the company’s book through the double-entry bookkeeping statement. Many organizations have implemented accounting software to largely automate their bookkeeping system to reduce manual intervention and human error.

Recording Business Events

As business transactions occur, the company will need to record these through the double-entry bookkeeping system. This is done via journal entries that record changes in the accounting equation resulting from the business event. Basic rules of debit and credit will be needed to make changes to the accounting equation in such a way that the accounting equation will always be in balance.

A general journal is a daybook or a master journal in which all company transactions that occur during an accounting cycle are recorded.

Journal Entry Format

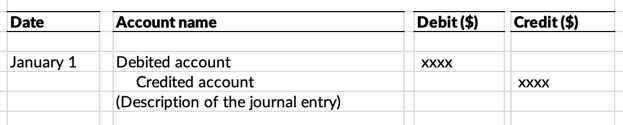

The journal entries will be required to be made based on the following format:

- The left column will contain the date of when the business transaction took place.

- The second column should contain the “account name” of the concerned accounts that are affected by that business transaction. The debited accounts should come first followed by the credited accounts. A short description of the nature of the transaction is also given below each journal entry. The rules of debit and credit bookkeeping system are explained in the next section.

- The third and fourth columns will include the total debit and credit amounts related to the journal entries. Remember, the debit amounts should equal the credit amounts, otherwise, the accounting equation will not balance.

Rules of Debit and Credit

The double-entry bookkeeping system ensures that each transaction is recorded through two different accounts. For this, a system of debit and credit has been devised.

- A debit entry will increase an asset or an expense account and decrease a liability or an equity account.

- A credit entry will increase a liability or an equity account and decrease an asset or an expense account.

Whenever a business transaction occurs, at least two accounts are impacted by a debit entry for one account and a credit entry for the other account. The total debits and credits should equal each other so that the accounting equation will always balance.

Balancing the Accounting Equation

Let us see how the debit and credit rules ensure that an accounting equation remains in balance. Assume a business starts with the following accounting equation at the start of the accounting cycle:

During the year, the following business transactions are recorded and analyzed:

- Bought equipment worth $10 million using cash.

- Purchased inventory costing $20 million on credit.

These business transactions would then be journalized in the general journal using the debit and credit rules in the following manner:

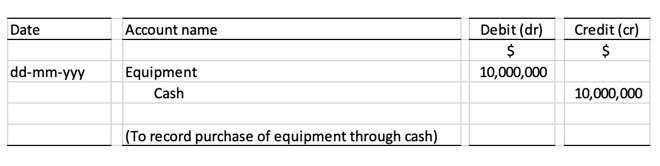

Journal Entry 1

As per the earlier mentioned rules of debit and credit system, any increase in an asset (equipment) is recorded as a debit entry and any decrease in an asset (cash) is recorded as a credit entry. Both entries will affect the accounting equation as the purchase of equipment would increase the assets side and the payment in cash would decrease the asset side.

So, what happens here is that assets increase by $10m because of the value of equipment that is debited but, at the same time, assets are reduced by $10m because $10m in cash has been spent to purchase the asset.

This means that the resulting value of the assets is $200m, and the accounting equation at the start of the period remains the same:

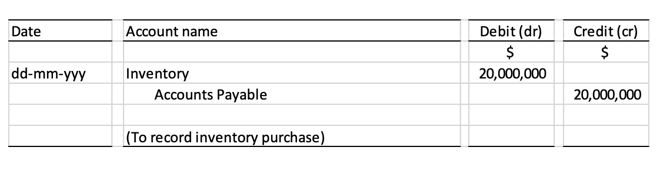

Journal Entry 2

With this journal entry, assets are increasing by $20m (to $220m) because we now have inventory worth $20m.

We purchased this on credit and not with cash, so in this case we need to credit the accounts payable (liability) account. Remember that crediting a liability account will increase the balance, and we now have liabilities of $220m.

The accounting equation now looks like this:

Conclusion

We have seen how a business transaction takes place and how the company makes use of the rules of debit and credit system to record these transactions in their books. To summarize the rules, we reiterate that:

- Increase in an asset account will be recorded via a debit entry.

- Increase in an expense account will be recorded via a debit entry.

- Increase in dividends or drawings account will be recorded via a debit entry.

- Increase in a loss account will be recorded via a debit entry.

- Increase in an income account will be recorded via a credit entry.

- Increase in a revenue account will be recorded via a credit entry.

- Increase in liability account will be recorded via a credit entry.

- Increase in shareholders equity account will be recorded via a credit entry.

Once the journal entries are successfully recorded in the general journal, they are posted to individual ledgers, after which the trial balance and financial statements are prepared.

One important concluding note here is that not all activity will be considered a business transaction. For instance, a memorandum of understanding (MoU) signed between two parties is just an agreement to a commitment and will not immediately result in a business transaction. If at a later date, a sale transaction occurs between the two parties, then only will result in a ‘business event’ since it will alter the accounting equation in one way or the other.

FAQs

1. What is a business event?

A business event is a business transaction in which there is an exchange of value between two groups. It is usually called an event when the transaction affects the accounting equation.2. What are the types of business events?

Types of business events in accounting include recording the deprecation of an asset, issuing shares, paying dividends, and incurring a loss.3. What is the impact of a business event on the company's financial statements?

The impact of a business event on a company's financial statements depends on the type of event. Some events, such as the sale of goods or services, will increase revenue and assets, while others, such as issuing shares or paying dividends, will decrease assets or liabilities.4. What is the difference between a business transaction and a business event?

A business transaction is an occurrence that has a financial impact on a company and can be recorded in the company's books. A business event, on the other hand, is an occurrence that has a financial impact on a company but may not necessarily result in a transaction.For example, issuing shares is a business event, but issuing shares does not automatically result in a transaction.