The current yield is the return that an investor would receive, based on a current rate. This formula is specifically used for calculating returns from bonds and is expressed as a percentage. To understand current yield, you should have a basic knowledge of a bond.

A “bond” is a debt tool that businesses use to increase their cash flow. Essentially, the investor loans money to the business with the promise of the money being returned at a later date along with interest. While the business sets an issue price (initial price), a bond also has a par value or face value. This amount determines the final value of the bond when it fully matures. However, a bond has a coupon (or interest) rate that provides income from the investment at certain dates. Typically, investors receive these interest payments twice a year.

When someone is considering purchasing (or investing in) a bond, they would want to have an analysis of what that bond would yield. The term “yield” is simply the earnings from an investment that are generated over a period of time. For a bond, there are three types of yields: the yield to call, yield to maturity, and the current yield.

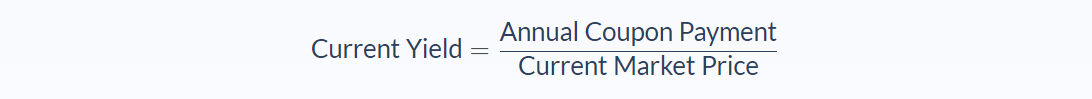

Current Yield Formula

To determine the current yield, you need to divide the amount of the coupon rate by the price the bond is currently selling for.

For the coupon amount, you would need to know the cash value that you are earning from the bond because of its interest. So, you would divide the par value by its interest rate and use the result for variable A.

For example, if a bond had a face value of $2000 and an annual coupon rate of 10%, that bond would give a payment once a year for $200. You would use the $200 for variable A, the coupon amount.

Essentially, that money would be considered the annual cash flow for that bond. Once a bond has reached maturity, it will still return the original amount paid into it. But the current yield can tell you how your annual cash flow would change based on the market price.

The current yield assumes the holder would have held the bond for a year. There is also the yield to call, which is where the bondholder would keep the bond until the call date listed on the bond.

You can also factor your investment if you were to hold a bond until it matures completely. This is also known as its yield to maturity. The current yield focuses more on its actual value now than on its value in the future.

Current Yield Example

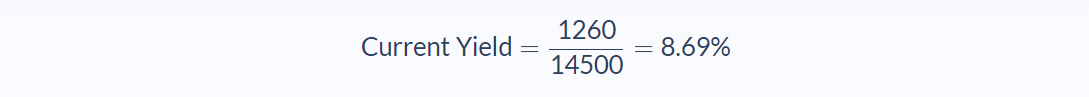

Maria purchased a bond for $18,000. The bond has an annual coupon rate of 7%. This means her coupon amount would be $1260 per year. The market price of the bond is $14,500. What would the current yield be based on this market rate?

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Annual cash flow: $1260

- Market price: $14500

We can apply the values to our variables and calculate the current yield:

In this case, the current yield would be 0.08689 or 8.69%.

Because the current yield amount is higher, Maria knows that if someone were to purchase the bond from her, they would get a better deal. The market would be in their favor, not hers. Essentially, the other buyer would have paid less for a bond that would return them the same amount. They would be making an overall profit on the investment, not just a profit from the annual cash flow.

Current Yield Analysis

A current yield is an analytical tool used to determine the immediate value of a bond based on the going market rate. It’s true, this calculation is very specific. It is focused solely on bonds and doesn’t have much use outside of that. But they are still important to learn.

The yield calculations (yield to call, yield to maturity, and current yield) are especially helpful for investors who want to be aware of the rate of their return. They can use this to compare the investment against other opportunities, evaluating what would be the best use of their money.

The company or group selling the bonds initially will certainly want to keep track of the current yield. This will help them to understand what it will cost them to bankroll these bonds. After all, the company will be responsible for both the return at the end of the bond’s life and for the annual payments. They will certainly want to watch the changes in the market closely so that they can plan appropriately.

Historically, the most well-known bonds have actually been handed out by the government. During times of war, the government has used bond sales to help fund the war effort. This was especially popular in the United States during World Wars I and II. In World War I, they were known as liberty bonds to promote a sense of patriotism. People would even hold parties and events to get others to encourage bond sales.

Purchasing bonds from the government is typically considered a fairly safe investment. This is because the power of the government would be backing and funding your bond and its annual payments.

Current Yield Conclusion

- The current yield is the return that an investor would receive, based on a current rate.

- The results of the formula are expressed as a percentage.

- Current yield is most often used in a bond analysis to calculate its return based on the bond’s current price.

- The formula for current yield involves two variables: annual cash flow and market price.

Current Yield Calculator

You can use the current yield calculator below to project how much a bond would return based on its current rate by entering the required numbers.

FAQs

1. What is the current yield?

The current yield is the percentage of return an investor would receive on their investment, based on the current market rate.

2. How is the current yield calculated?

The current yield is calculated by dividing the annual cash flow by the market price.

3. What is the purpose of the current yield?

The current yield is used to determine the immediate value of a bond based on the going market rate. It can help investors compare the investment against other opportunities.

4. Is a higher current yield better?

A higher current yield means that the other buyer would have paid less for a bond that would return them the same amount. They would be making an overall profit on the investment, not just a profit from the annual cash flow.

5. Why is the current yield less than the yield to maturity?

The current yield is less than the yield to maturity because it considers the time value of money. The yield to maturity does not factor in this concept.