Preparing financial statements is perhaps one of the most important steps of the accounting cycle. These statements represent the end purpose of the financial reporting and the accounting system.

Preparing financial statements can be a simple or a very sophisticated process based on the company size and its requirements. Some financial statements might need footnotes and disclosures as well. Financial statements are prepared using the individual account balances listed in the adjusted trial balance in the preceding step.

The three financial statements are:

- Income statement

- Balance sheet

- Cash flow statement (statement of cash flows)

The Accounting Cycle Example

Throughout this series on the accounting cycle, we will look at an example business, Bob’s Donut Shoppe, Inc., to help understand the concepts of each part of the accounting cycle. Below is the complete list of accounting cycle tutorials:

- Journal Entries

- T-Accounts

- Unadjusted Trial Balance

- Adjusting Entries

- Adjusted Trial Balance

- Preparing Financial Statements (you are here)

- Accounting Worksheet

- Closing Entries

- Income Summary Account

- Post-Closing Trial Balance

- Reversing Entries

We also have an accompanying spreadsheet which shows you an example of each step.

Click here to download the Accounting Cycle template

The Income Statement

The income statement will show the company’s performance for each period. It will start with sales revenue and then deduct the cost of goods sold from it to arrive at the gross profit. After that, the operating expenses are deducted to arrive at the “bottom line” – net profit.

Key features

- Topline includes the net sales (sales revenues minus returns by customers)

- Operating costs include cost of goods sold (beginning inventory plus purchases minus closing inventory)

- Accounting principles of matching and accrual accounting used

- Operating expenses for the year could include rent expense, insurance, utility expense, etc.

- Net profit shows the bottom line of the business

- Income statement can be used to assess the profitability

Bob’s Donut Shoppe Inc Example

Key points to note:

- Bob’s company is earning a net loss of $6,050 for its first month of operations.

- He has a gross profit of $2,400.

- However, his expenses of $8,040 exceed his gross profit.

The Balance Sheet

The balance sheet reflects the financial position of the company at a given point in time. It includes assets, liabilities and equity. The accounting equation comes into play here again as assets should equal liabilities plus equity.

The balance sheet begins with the assets section which would include both fixed assets and the current assets of a company. Net fixed assets can be calculated by subtracting the accumulated depreciation expense from the gross fixed assets. The current assets are all those items that are either cash or can be converted to cash within one year. These include cash and cash equivalents, accounts receivable, inventory, prepayments, etc.

The liabilities section of the balance sheet will include both current liabilities and non-current liabilities. Current liabilities are those obligations that must be repaid within one year and can include accounts payable, current portion of long-term debt, accrued expense, bank overdraft, current lease payable etc. The long-term liabilities are obligations that go beyond one year and include bonds payable, long-term loans, capital leases, pension liabilities, etc.

The equity side of the balance shows the position of capital raised by the shareholders. It should, therefore, be equal to assets minus liabilities. The equity side of the balance sheet would include components like commons stock, preferred stock, additional paid-in capital, retained earnings, treasury stock, etc.

Key features

- Shows the financial position of a company

- Snapshot at a given time in point

- Consists of three section – assets, liabilities and equity

- Can be used for purposes of various ratio analysis

Bob’s Donut Shoppe Inc Example

Bob’s balance sheet position would look like the following:

Key points to note:

- Assets equal liabilities plus capital.

- Total liabilities are slightly higher than capital.

- Accumulated depreciation will be equal to first month depreciation expense.

The Cash Flow Statement

The cash flow statement is sometimes very important in running the operational day to day of a business. This statement will give a fair idea of how much cash has been generated by the company from operations and if that cash has been used in financing or any investing activities.

The cash flow statement is prepared by taking the net income figure from the income statement and adjusting it for all non-cash expenses such as depreciation. Changes in working capital are also adjusted to arrive at net cash flow from operations. Then follows the sections related to investing activities such as investment in a new property, plant or equipment. After that, the financing section includes components such as the issuance of new common stock, repayment of debt, issuance of debt etc.

Key features

- Shows changes in overall cash levels of a company

- Follows the cash accounting principle

- Consists of three segments – cash flow from operations, cash flow from investing activities and cash flow from financing activities

- Expressed for a given time period

Bob’s Donut Shoppe Inc Example

Key points to note:

- Although the earnings are negative for the month, the net cash flow from operations is positive. This can be explained due to the difference between cash accounting vs accrual accounting.

- Investing activities would include renovations and improvements.

- Financing activities include issuance of common stock, borrowing from bank and paying out dividends.

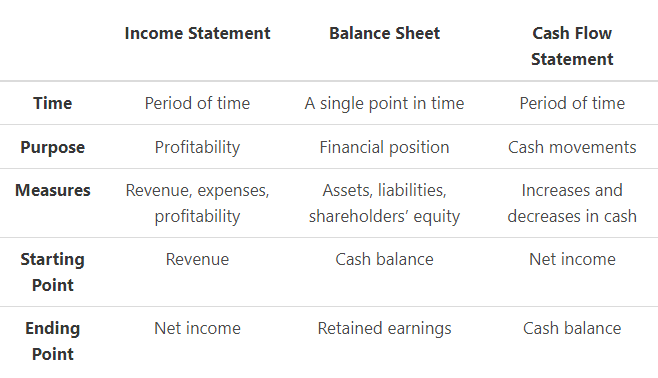

Financial Statement Comparisons

The table below might be helpful in remembering what each financial statement is used for and why:

Next Step

Once the financial statements have been prepared, Bob or his bookkeeper can add them to the accounting worksheet (which is essentially an internal spreadsheet that can be used to track the accounting cycle for the period).

When the accounting worksheet is updated, the books can be closed by recording closing entries.

FAQs

1. What is a financial statement?

A financial statement is a formal document that shows the financial position of a company at a given point in time. The three main sections are the assets, liabilities, and equity of the company.

2. Why are financial statements important?

Financial statements are important to investors because they give a snapshot of the financial position of a company and can provide information about a company's profitability, cash flow, and financial health.

3. What are the 4 most common financial statements prepared?

The 4 most common financial statements are the income statement, balance sheet, cash flow statement and statement of shareholders' equity.

4. What are the 9 steps in preparing financial statements?

The 9 steps in preparing financial statements are:

1) Identify all business transactions for the period

2) Record transactions in a general journal

3) Resolve anomalies and make adjusting journal entries

4) Post the adjusted journal entries to the general ledger

5) Prepare an income statement

6) Prepare a balance sheet

7) Prepare a cash flow statement

8) Prepare a statement of shareholders' equity

9) Close the books for the period

5. Can you provide an example of a financial statement?

An example of a financial statement is the balance sheet, which shows the assets, liabilities and equity of a company at a given point in time. The income statement shows the revenue, expenses and net income of a company for a given period of time.

The cash flow statement shows the changes in a company's cash balance for a given period of time. The statement of shareholders' equity shows the changes in a company's equity for a given period of time.