Present value factor, also known as present value interest factor (PVIF) is a factor that is used to calculate the present value of money to be received at some future point in time. In other words, this factor helps us to determine whether cash received now is worth more, or less than when it is received later.

The Present Value Factor is an integral component in the calculation of the present value of money under the Discounted Cash Flow (DCF) model for determining the present value of future cash flows of an investment and is always less than one.

Present value factor is often available in the form of a table for ease of reference. This table usually provides the present value factors for various time periods and discount rate combinations. While using the present value tables provides an easy way to determine the present value factor, there is one limitation to it.

You can use our free, online calculator to generate a present value of $1 table which can then be printed or saved to Excel spreadsheet.

The accuracy level of the present value factors in the present value tables is slightly less since most of the present value tables round off the PV factor value to three or four decimal places at the most. Therefore, the most optimal way to calculate the present value factor would be to use its actual formula.

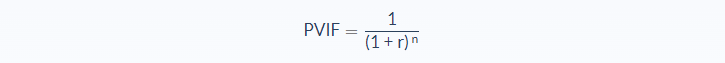

Present Value Factor Formula

- r = discount rate or the interest rate

- n = number of time periods

The above formula will calculate the present value interest factor, which you can then use to multiple by your future sum to be received.

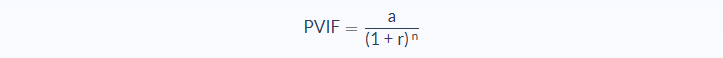

You could also skip that step by using the formula below, which will give you the actual present value of the amount:

- a = the future sum to be received

- r = discount rate or the interest rate

- n = number of time periods

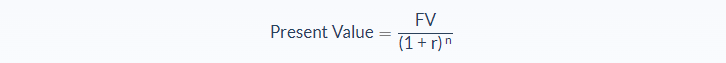

It is derived from breaking down the formula for calculating present value which is,

- FV = Future value

- r = Rate of return

- n = Number of periods

The two factors needed to calculate the present value factor are the time period and the discount rate.

The time period is essentially the time duration after which the money is to be received and can be expressed in terms of years, months, or days.

The discount rate or the interest rate, on the other hand, refers to the interest rate or the rate of return that an investment can earn in a particular time period. It is called so because it represents the rate at which the future value of money is ‘discounted’ to arrive at its present value.

It is important that this discount rate not be confused with the ‘other’ discount rate, which refers to the interest rate charged by federal banks on its loans and advances to commercial banks and other financial institutions.

Present Value Factor Example

Company S sold goods worth $1000 to Company B. Company B offered to pay Company S using one of the following options:

- $1000 immediately on receipt of the goods or

- $1200 after two years.

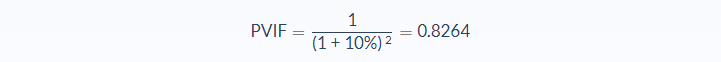

Discount rate is 10%. Which option should Company S choose?

In order to determine which option would be better, we will need to

- Calculate the present value factor for the discount rate of 10% for 2 years.

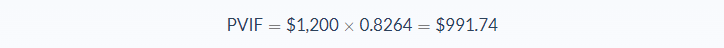

- Multiply this present value factor with $1200. This will be the present value of $1200 when it is discounted at a rate of 10% for 2 years.

- Finally, we will compare that amount with $1000 and identify which is higher.

From the above calculations, we can establish that the present value of $1200 is less than $1000. Therefore, Company S should choose to receive $1000 today rather than waiting for 2 years.

Present Value Factor Analysis

The Present Value Factor is based on the concept of the time value of money, which states that a dollar received today is more valuable than a dollar received in the future. The reason being the value of money appreciates over time provided the interest rates remain above zero.

Also when money is received today, it reduces the inherent risk of uncertainty that you may or may not receive that money in the future.

Put differently, the present value of money is inversely proportional to the time period. The longer it takes to receive the money, the lower its present value will be.

In our above example, if Company S chooses the first option and receives the $1000 immediately from Company B, then it has the option to invest this money in an investment scheme that provides a higher rate of return. This way, it can earn extra money from the $1000 rather than waiting for it for two years and losing out on the opportunity cost.

The concepts of present value and present value factors play an important role in investment valuation and capital budgeting. Continuing with our earlier example, if Company S wants to invest the $1000 that it received from Company B in buying new machinery, it will need to determine whether the present value of future cash flows from this investment will be more or less than the investment of $1000. Say, the present value of future cash inflows exceeds the present cash outflow of $1000, then the machinery is worth investing, else it would serve better for Company S to invest the money in other more profitable avenues.

Lastly, present value factor also plays an integral role in other capital budgeting techniques such as net present value, discounted payback, and internal rate of return.

Conclusion

To summarize, the following are some of the facts to bear in mind while using present value factor:

- Present Value Factor is an integral component in the calculation of present value of cash flow under the Discounted Cash Flow model of investment valuation.

- It is based on the concept of time value of money which stipulates that as long as interest rates remain above zero, the value of money always appreciates over time

- The two critical determinants needed for calculation of present value factor are time period and the discount rate

- Present Value tables provide the present value factors for different time periods and discount rate combinations for easy reference

- Present Value Factor plays an important role in investment valuation and capital budgeting process

Present Value Factor Calculator

You can use the present value interest factor (PVIF) calculator below to work out your own PV factor using the number of periods and the rate per period.

FAQs

1. What is the present value interest factor?

The present value interest factor is the value of money in the future discounted at a given interest rate for a specific time period. This number is used for investment valuation, capital budgeting projects, etc.

2. How do you calculate the present value interest factor?

The formula for Present Value Interest Factor is:

PVIF = 1 / (1+r)n

r = discount rate or the interest rate

n = number of time periods

The above formula will calculate the present value interest factor, which you can then use to multiply by your future sum to be received.

3. What is the present value interest factor of an annuity?

The present value interest factor for an annuity is the sum of the factors when each payment will be received.

4. How do you find the present value (PV )factor in the PV factor table?

To find the present value factor in a pre-computed table, you have to select the time period and discount rate. Then, you will get a result that can be used for multiplication.

5. What does present value mean in accounting?

Present value is an important concept in accounting that is applied to assets. The assets become more valuable over time, which means their present value increases with time.

In addition, the lower the time period, the higher will be the present value of an asset.