The double-entry bookkeeping system, also called double-entry accounting, is a common accounting system that requires every business transaction to be entered in at least two different accounts.

It’s based on the concept of the accounting equation (assets = liabilities + equity) and the debits and credits for each financial transaction must be equal.

The double-entry accounting method was invented way back in the 17th century primarily to resolve business transactions and make trade more efficient between traders.

Today, every modern accounting system framework is based on double-entry accounting as at least 2 accounts are affected after every transaction. In fact, you probably won’t be able to save the entries in your system unless the transaction balances.

Importance of Double-Entry

The double entry system helps accountants reduce mistakes, it also helps by providing a good check and balance benefit. The double-entry accounting method gives you more complete information about a transaction when compared to the single-entry method, as each transaction consists of both a destination and a source.

Before computer software made double-entry bookkeeping easier for small companies, there might have been an argument for using single-entry and a cash book for very small and simple businesses.

But really, all modern accounting software uses double-entry and it’s the recommended method for most businesses now because of the increased accuracy and efficiency when recording transactions.

Basics of The Double-Entry System

Accounting Equation

The double entry system is used to satisfy the principle of the accounting equation which says that the assets are equal to liabilities and owner’s equity.

For example, if Sam pays back his loan, there will be two corresponding entries as per the double-entry system, where the assets of Sam will decrease when he pays cash and the liabilities of the company will decrease as the loan is a liability. It is important to note that both entries will be for the same amount.

As you can see in the illustration above, the debits and credits used in double-entry accounting affect the account balances in different ways.

Debits and Credits

Debits and credits are very important to the double-entry system. In accounts, debit refers to an entry on the left side of the accounting ledger, and credit is defined as an entry that is recorded on the right side of the account. The total of both, debit and credit, must be equal for a transaction to be considered “balanced”.

As explained earlier, for each transaction there will be at least two entries made. One entry will be recorded on the debit side, while the other entry will be recorded on the credit side.

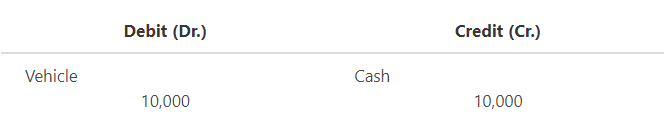

For a better understanding of the double-entry concept in relativity to debit and credit, a graph is constructed below to illustrate a business transaction. Company A buys a vehicle for $10,000 in cash.

The simple table above shows us that there was one transaction made by Company A, however as the new vehicle was bought for cash, there were two corresponding entries.

The vehicle, which is an asset, increased and was recorded on the debit side while the cash account which was used to buy the vehicle was reduced and this was recorded on the credit (right) side. This example shows us the relation of double-entry, with the rule of debits and credits.

The exhaustive list of rules of debit and credit are given below:

- Increase in an asset account will be recorded via a debit entry.

- Increase in an expense account will be recorded via a debit entry.

- Increase in dividends or drawings account will be recorded via a debit entry.

- Increase in a loss account will be recorded via a debit entry.

- Increase in an income account will be recorded via a credit entry.

- Increase in a revenue account will be recorded via a credit entry.

- Increase in liability account will be recorded via a credit entry.

- Increase in shareholders equity account will be recorded via a credit entry.

The Accounting Cycle and Double-Entry

The accounting cycle is a chain of steps which set the procedures for a business to collect, record and analyze its financial data. The accounting cycle varies from different business categories. For example, a retail company’s accounting cycle will differ, that from a manufacturing business.

There are usually 10 steps of a complete accounting cycle and all steps require the use of double-entry accounting. For example, one of the steps of the accounting statements is to journalize entries for transactions, which involves the use of the double-entry system as two entries are recorded.

Similarly, another step of an accounting cycle is to prepare financial statements. All financial statements whether a balance sheet, income statement or a cash flow statement use the double-entry system for efficiency and accuracy of financial transactions recorded.

Types of Accounts in a Double Entry Accounting

There are various accounts used to record entries through the use of the double-entry system. There are 7 major accounts where all financial transactions are categorized in.

Asset Account

This account records all the assets owned by a company. Examples of asset accounts are cash, accounts receivables, Equipment and inventory account. The asset account increases when there is an influx of assets and decreases when assets are reduced.

Liabilities Account

The liabilities account shows all the amounts owed by the company to another corporation. Examples of Liability accounts are Accounts Payable, Notes Payable. As a company borrows cash and buys goods and services on credit, the liabilities increase. Conversely, as liabilities are paid back, the balance on the account is reduced.

Equity Account

The equity account shows the capital of the owner and records further investments and profits into the business. The equity account is decreased when a company faces losses and if the owner takes out cash for personal use which is known as drawing.

Expenses and Revenue

The expenses account shows all the expenses incurred by a business, such as paying rent, electricity bill and salaries. The more the expenses of the business the lesser the net profit. The revenue account shows all the sales made by the business. The higher the revenue, the higher the gross profit of a company.

Gains and Losses

Gains and losses are the financial results of a company’s non-primary operations and production processes. The increase in the value of a company is known as the gains. On the other hand, the losses are recorded when a company loses money through secondary activity.

Examples of Double Entry Transactions

For a better knowledge of the double-entry system, here are a few simple examples which will develop a better comprehension of the concept.

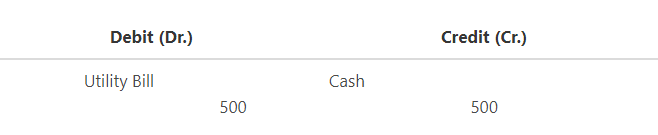

James, who has paid the $500 for the utility bill, records the transaction through the rule of the double-entry system, where the expenses account will increase by $500, which will be debited. The cash will be credited by $500 as the cash account is reduced. This can be shown through an extract of a General Journal.

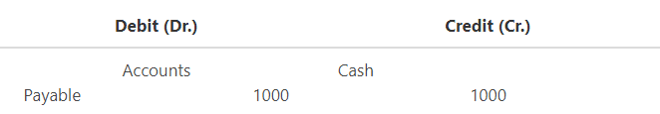

Harry has cleared his account with his creditor, John after he paid $1000. This transaction is recorded by Harry by reducing the liabilities account after clearing his amount and debiting the accounts payable by $1000 and crediting the cash as the cash account is reduced. This transaction is explained below using a general journal.

FAQs

1. What is double-entry bookkeeping?

Double-entry bookkeeping is a system of recording all the financial transactions that are completed by an individual or company. Through this method, two entries are written for each transaction to ensure there are no errors in calculations. This also provides accurate results at the end of the accounting process.

2. How do you write a double-entry bookkeeper?

Firstly, record the transaction in an account book or journal. Then, debit the expense account and credit another asset account.

After which you will record the same transaction in another account book or journal, but this time you will credit the expense account and debit another asset account.

3. What are the differences between single entry and double-entry bookkeeping?

Single-entry bookkeeping allows for transactions to be recorded in one account. However, double-entry bookkeeping requires that the same transaction is recorded by crediting one asset and debiting another.

Another difference is that double-entry bookkeeping provides more accurate information in the end.

4. What is the format of double-entry?

Double-entry is composed of 3 main parts, namely the debit, journal, and credit.

5. What are the types of accounts in double entry accounting?

Double-entry accounting has 5 types of accounts which are:

Asset - This account holds the money or items that the business owns minus any items it owes.

Liabilities - This account keeps track of bills and debts that a company owes.

Equity - The equity is equal to the assets of a business minus its liabilities. It shows how much money would be left for owners if all their financial obligations were paid off.

Expenses and Revenue - These accounts show how much a company has spent and earned from its operations.

Gains and Losses - These accounts show how much money a company has gained or lost due to selling items for more than they were bought or buying items for less than their value.